Menu

- Technological Infrastructure and Equipment Challenges

- Initial Investment and Operational Cost Burden

- Impact on Operations and Staffing

- Awareness and Adaptability of Small Businesses and Households

- Integration and Data Synchronization with Tax Authority Systems

- Comparison: Cash Register Invoices vs. Traditional Invoices

- Solutions and Strategic Recommendations for Effective Implementation

- Conclusion

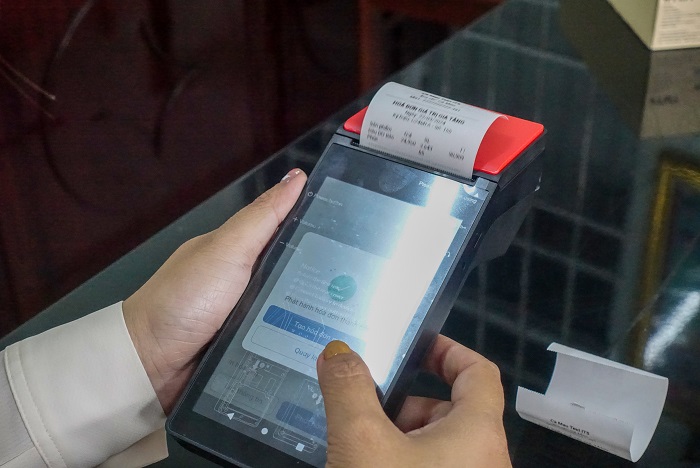

Since July 1, 2022, Vietnam has mandated the use of e-invoices nationwide under new regulations. Specifically, the implementation of POS e-invoices has been piloted by the General Department of Taxation since December 15, 2022, focusing on businesses that provide goods and services directly to consumers such as restaurants, eateries, hotels, supermarkets, consumer retail, shopping centers, pharmacies, and entertainment services.

lthough the legal framework and detailed implementation plan are in place, the adoption of cash register invoices has not been made absolutely mandatory. Under current regulations, businesses may still use multiple forms of e-invoices and are allowed to issue a single consolidated invoice at the end of the day for retail or dining transactions. This means businesses are not yet required to issue an e-invoice for each transaction at the point of sale. As a result, many businesses are merely participating in the pilot phase without fully implementing the model, preferring to wait until legal obligations are enforced. In Ho Chi Minh City, some businesses have known they fall within the pilot group since late 2022 but have not adopted the system, stating, “We’re still in the pilot phase; we’ll comply once it becomes mandatory.”

Technological Infrastructure and Equipment Challenges

One of the major challenges in implementing cash register e-invoices is the requirement for technological infrastructure at the point of sale. Many small businesses and households lack modern cash registers or sales software. In the past, many stores used handwritten logs, paper invoices, or simple non-networked cash registers. Transitioning to the new model requires them to invest in or upgrade equipment, ensuring each sales point has a cash register/POS capable of printing invoices and maintaining a stable internet connection. Not all types of cash registers on the market support data transmission to tax authorities, meaning many businesses may need to replace or upgrade their existing devices. Additionally, businesses must install compatible e-invoice software to synchronize with their sales systems and meet the data standards of the General Department of Taxation.

Setting up this new infrastructure demands time and technical knowledge. For businesses without a dedicated IT team, integrating the system can be overwhelming. Chain store or supermarket models face the additional challenge of ensuring uniform implementation across all locations — every sales point must be equipped and operate consistently in issuing invoices from cash registers. Moreover, the requirement for constant internet connectivity at sales points poses a challenge in areas with poor network infrastructure or for household businesses in traditional markets, which previously did not rely on the internet for sales.

Initial Investment and Operational Cost Burden

Infrastructure upgrades come with cost concerns. Implementing cash register e-invoices requires upfront investment: purchasing cash registers or POS systems capable of printing e-invoices, receipt printers, barcode scanners (if needed), and installing integrated sales and e-invoice software. Many businesses are concerned about the cost of upgrading their cash register systems, software integration, and training staff to use the new system. For small businesses, this investment is even more significant due to their limited scale and profits.

In addition to upfront costs, businesses must also consider recurring operational expenses: fees for using e-invoice services (usually based on the number of invoices or service packages), internet connection maintenance, receipt paper replacement, and equipment maintenance. Although the tax sector insists that adopting cash register e-invoices does not add significant costs — and may even save time and resources compared to managing paper invoices — taxpayers are generally still wary of “additional expenses.” Many businesses admit to hesitating due to cost concerns, even though they understand the benefits of this invoice model.

Over time, non-compliance may lead to administrative penalties. According to draft regulations, businesses required to implement e-invoices but fail to do so may face fines ranging from VND 10 to 20 million, or even business suspension in severe cases. To ease the burden, supportive policies are needed. In some localities, tax authorities have partnered with solution providers and POS vendors to offer cost-effective options. From the business perspective, the transition should be seen not as an added cost, but as a long-term investment in operational modernization and compliance risk mitigation.

Impact on Operations and Staffing

Deploying e-invoices from cash registers introduces notable changes in both sales procedures and internal management. Previously, many retail stores issued a single invoice at the end of the day (or periodically) for all daily retail revenue. In restaurants and hotels, invoices were often manually generated after the customer used services, and clients might receive the official red invoice days later from accounting. Under the new model, an e-invoice must be issued for each retail transaction in real-time, printed from the cash register and given to the customer immediately. This shift requires cashiers and sales staff to adapt to new workflows: operating POS systems or sales software to issue an invoice for each transaction, rather than just accepting payment and making simple notes as before.

In the early phase, delays and confusion among staff are expected due to the extra steps in the system. Network latency or system glitches may result in payment queues, affecting customer experience—a significant concern for businesses during this transition.

Therefore, thorough staff training is essential. Cashiers, salespeople, accountants, and store managers must all be trained to use the new e-invoicing system. Initially, having on-site support staff to handle issues is advisable. Accounting teams must also revise their reconciliation processes: instead of collecting paper invoices at month-end, they will now monitor daily e-invoice data submitted to tax authorities, ensuring accuracy before submission. Business managers must also oversee staff compliance to guarantee that invoices are issued accurately and consistently.

Awareness and Adaptability of Small Businesses and Households

Small businesses and individual household businesses—those who sell directly to consumers—are a key focus group in the rollout of cash register invoicing. However, this group also faces significant challenges in mindset and readiness. Firstly, many taxpayers are wary of increased oversight. Real-time invoice data shared with tax authorities leads to concerns about full revenue visibility, eliminating the option of underreporting for tax minimization.

For businesses accustomed to informal practices and minimal reporting, issuing e-invoices for each transaction may feel like a restriction of their operational freedom.

Additionally, a strong resistance to change and lack of digital literacy remain widespread. Many small business owners and older shopkeepers lack technical skills, and the mention of cash registers and e-invoicing software seems complicated and off-putting. This leads to procrastination and a mindset of “we’ll wait until it’s mandatory.” Surveys have shown that even when benefits are acknowledged, concerns about costs and the absence of enforcement result in limited actual implementation. This mindset has led to a “tick-the-box” approach during the pilot phase: businesses may register but rarely use the system. The long-term value of e-invoicing is not yet fully understood by the broader small business community.

Consumer behavior also plays a role. In Vietnam, shoppers rarely request invoices unless needed for company reimbursement or warranty purposes. The lack of consumer demand for invoices reduces sellers’ motivation to issue them for every transaction. Businesses argue that customers buying small items often refuse receipts, making invoicing seem like unnecessary effort and expense.

In summary, the challenges are not solely technical or financial—they are also human and cultural. Small businesses must shift their mindset from avoidance to proactive engagement: seeing transparent revenue and tax compliance as foundations for sustainable business rather than burdens.

Integration and Data Synchronization with Tax Authority Systems

From a technical perspective, seamless data transmission from a business’s cash register system to the tax authority’s system is a major challenge. Cash register e-invoices require near real-time or periodic submission of invoice data to the General Department of Taxation. According to regulations, businesses may transmit invoice data at the end of each day—meaning that invoices can be printed for customers during the day, but all must be submitted to tax authorities by day’s end.

This requires that business software be 100% compliant with the tax authority’s data standards and that internet connections remain stable to avoid interruptions. In the early stages, some businesses encountered issues due to incompatibility between sales software and the new e-invoicing system, leading to data submission errors.

Data security is another concern. Transmitting invoice data via the internet can be risky without proper encryption. Both businesses and solution providers must adhere to the General Department of Taxation’s security protocols, including secure connections and valid digital certificates for signing and encrypting data.

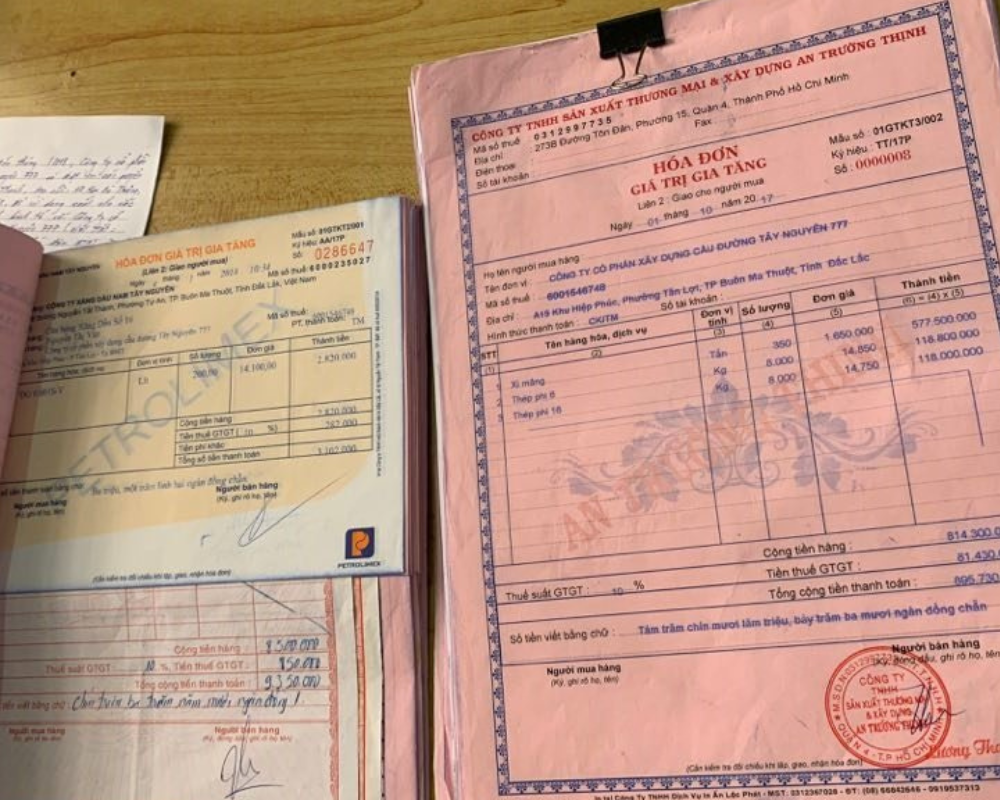

Comparison: Cash Register Invoices vs. Traditional Invoices

The shift from traditional invoicing models to cash register e-invoices involves more than just a change in tools—it requires new processes and perspectives on revenue management. Below are key differences:

- Issuance Speed: Traditional models (especially paper or standard e-invoices with tax codes) often involve delays. Systems may be unavailable outside business hours, preventing immediate invoicing. In contrast, cash register invoices can be issued instantly at any time, with printed copies considered valid e-invoices without waiting for immediate tax authority approval.

- Convenience and Flexibility: Paper invoicing is manual and error-prone. Traditional e-invoices reduce manual work but require formal correction procedures. Cash register invoices offer more flexibility; errors discovered during the day can often be corrected before data submission without voiding the printed invoice.

- Digital Signature Requirements: Standard e-invoices require a digital signature and tax authority code for every invoice, necessitating on-site signing devices or server connections. Cash register invoices, once pre-registered with the tax authority, do not require a digital signature on each invoice. A signature is only needed during end-of-day data aggregation.

- Operational Habits: The old model allows greater (but riskier) flexibility, such as issuing only end-of-day or on-demand invoices. The new model requires discipline—every transaction must be invoiced, ensuring complete revenue recording. This benefits tax transparency and creates fairer competition, reducing advantages for tax-evading entities.

- Management and Storage: Cash register e-invoices automate revenue recording and document storage. Business owners can access daily sales and tax reports, and invoices can be verified through the tax authority’s online portal. In contrast, paper invoices are hard to retrieve, and standard e-invoices are not as tightly linked to specific points of sale.

Solutions and Strategic Recommendations for Effective Implementation

To overcome the challenges of implementing cash register invoicing, a collaborative effort is required between authorities and businesses. Key solutions include:

- Strengthen Legal Framework and Government Support: Clear, unified regulations are essential. Mandatory implementation timelines should be established, especially for targeted industries. Transitional support such as financial incentives (e.g., subsidizing initial software costs or allowing hardware investments to be tax-deductible) can ease the burden. Local tax offices should offer training and technical support, particularly for small businesses.

- Choose the Right Technology Partner: Businesses should carefully select reputable e-invoicing solution providers that offer POS integration, user-friendly systems, stable data transmission, and reliable technical support. Businesses with existing ERP or sales software should coordinate with providers for integration rather than starting from scratch. Contingency plans should also be developed to handle internet outages or data submission delays.

- Invest in Training and Process Optimization: Staff training must precede full implementation. Trial runs at selected locations can help staff adapt. Assigning a digital transformation lead to oversee progress, resolve issues, and manage accountability is crucial. Clear procedures should be established for invoice issuance, system troubleshooting, data reconciliation, and compliance monitoring.

- Gradual Mindset Shift and Cultural Change: Small businesses can start with small steps—encouraging customers to take invoices, posting messages like “Please collect your invoice for your benefit” at checkout counters, or assigning younger, tech-savvy family members to manage the invoicing system. Public campaigns should promote the societal benefits of cash register e-invoices to shift business culture. When all vendors comply and customers expect invoices, fair competition and tax compliance become the norm.

Conclusion

The implementation of POS e-invoices marks a significant step toward a transparent and equitable digital economy in Vietnam. While the transition presents challenges—ranging from infrastructure and cost to mindset and process changes—it aligns with international standards in modern tax administration. In the long run, the benefits are clear: businesses become more professional and reduce compliance risks, while the government improves revenue management and creates a level playing field.

Realizing this vision requires collective effort: a strong legal foundation and support from authorities, proactive upgrades and mindset shifts from businesses, and engagement from consumers. With thorough preparation and a shared commitment to change, Vietnamese enterprises can successfully navigate this transition and embrace a digitally empowered future in finance, accounting, and business management.