Menu

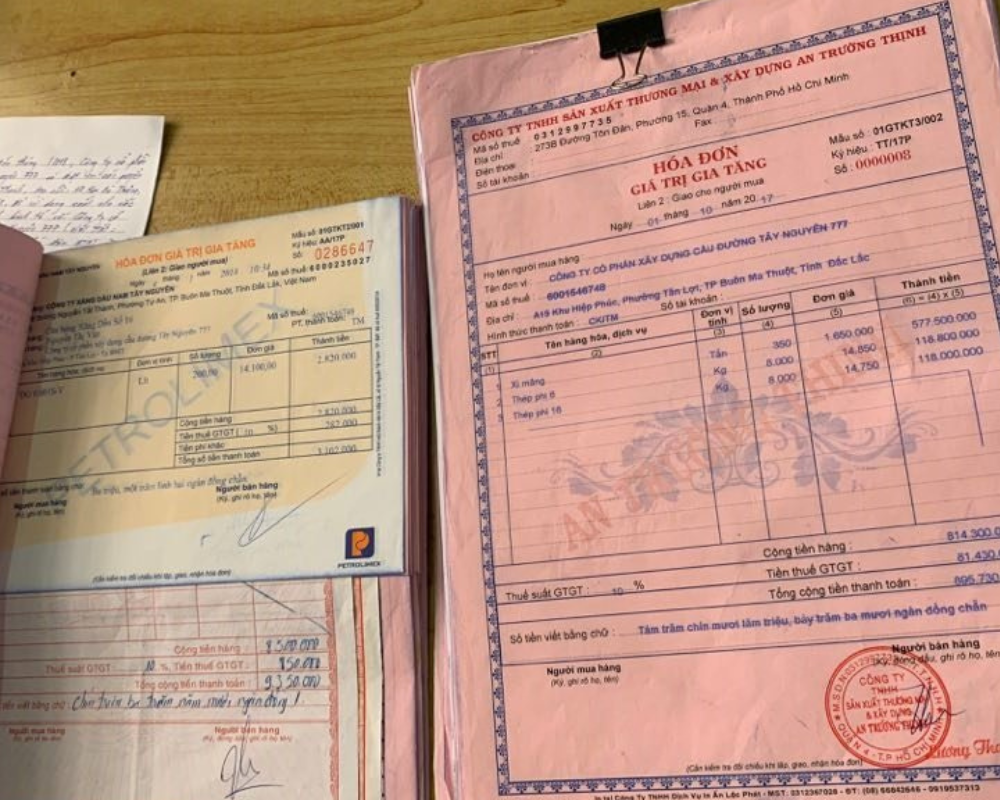

Decree 123/2020/NĐ-CP (abbreviated as Decree 123) is an important regulation issued by the Government on invoices and documents in business operations. Promulgated on October 19, 2020, and effective from July 1, 2022, Decree 123 replaces a series of previous regulations on invoicing (such as Decree 51/2010, Decree 04/2014, and Decree 119/2018). This decree mandates that all businesses nationwide must switch to using electronic invoices in place of traditional paper invoices.

What is Decree 123/2020/NĐ-CP?

Decree 123/2020/NĐ-CP is a legal document regulating the management and use of invoices when selling goods and providing services, as well as the management of documents when carrying out tax, fee, and charge procedures. This decree defines the duties, powers, and responsibilities of related parties (enterprises, electronic invoice service providers, tax authorities, etc.) in issuing, using, and managing invoices and documents. With its enforcement starting from July 1, 2022, Decree 123 becomes the official legal framework for e-invoicing, aiming to modernize tax accounting and enhance transparency in transactions of goods and services.

Before the issuance of Decree 123, the invoicing system was governed by Decree 51/2010 and 04/2014 (for paper invoices), and Decree 119/2018 (for e-invoices). The introduction of Decree 123 consolidated and replaced these documents, creating a unified legal corridor. As a result, businesses no longer need to apply multiple overlapping regulations but instead comply with a single decree on invoices and documents.

Requirements for Businesses under Decree 123

To comply with Decree 123, businesses—especially small and medium-sized enterprises—need to implement several important requirements and changes in their invoicing and tax accounting practices:

- Transition to the e-invoice system: If a business previously used paper invoices or self-printed invoices, it must switch entirely to e-invoicing before the deadline (July 1, 2022). This requires businesses to prepare technical infrastructure (computers, digital signatures, e-invoice software) or subscribe to e-invoice services from reputable providers to meet regulatory requirements.

- Registering e-invoice issuance with tax authorities: Before using e-invoices, businesses must register via the General Department of Taxation’s portal or through an authorized intermediary. Registration documents usually include the decision to apply e-invoices and company details as per templates. After approval from the tax authority, the business will issue sample e-invoices and make an official issuance announcement as prescribed.

- Training employees and updating internal processes: Transitioning to e-invoicing may be new to some small and medium enterprises, so it is necessary to train accounting and sales staff to understand how to issue e-invoices in the new system. Businesses should establish or update their invoicing, circulation, and storage procedures to ensure compliance and consistency.

- Ensuring proper e-invoice storage and retrieval: E-invoices must be securely stored in computer systems or cloud services provided by the supplier, ensuring they are not lost, damaged, and can be easily retrieved when needed. Businesses must comply with invoice retention periods according to accounting law (typically 10 years). They should also implement regular data backup plans as a precaution.

- Notifying customers and partners: When switching to e-invoices, businesses should inform customers and partners about the change in invoicing format. This helps customers understand and cooperate in receiving e-invoices (via email or portals) instead of requesting paper invoices. Proactive communication enhances professionalism and encourages cooperation from business partners.

Proper implementation of these requirements will help businesses fully comply with Decree 123, avoid legal risks (such as penalties for invoice violations), and at the same time take advantage of the benefits e-invoicing brings (cost savings in printing and storage; convenience in accounting and tax declaration).

Which Businesses Should Pay Attention to Decree 123?

Decree 123 affects most businesses and business organizations in Vietnam, though the level of impact may vary depending on size, industry, and operational characteristics of each entity:

- Retail and direct-to-consumer service businesses: Businesses and stores in retail, supermarkets, convenience stores, pharmacies, restaurants, cafés, hotels, etc., are among the most directly affected. These entities must issue invoices for a large volume of daily transactions. Decree 123 requires them to implement POS (point-of-sale) systems connected to the tax authority to quickly issue e-invoices for each retail transaction. This compels traditional stores to undergo digital transformation and invest in new sales and invoicing technology. While initial challenges may arise, in the long term this helps automate invoicing, reduce customer wait times, and ensure revenue is fully reported.

- SMEs not yet applying advanced technology: Traditional small and medium-sized enterprises (SMEs) accustomed to manual paper invoicing or outdated accounting methods will face significant impact when switching to e-invoicing. These businesses need to change habits, update workflows, and invest in an e-invoice system. SME managers should pay close attention to Decree 123 to avoid passive transitions. Without timely preparation, invoicing may be disrupted, affecting sales and leading to legal penalties for non-compliance.

- Online and e-commerce businesses: In practice, many online sellers previously may not have issued invoices for each small order. However, Decree 123 mandates that every sales transaction must have an invoice. E-commerce businesses and online sellers must integrate e-invoicing into their order fulfillment processes. This helps legitimize revenue and increases transparency. These businesses usually have a tech advantage, so integration may be smoother, but they must still ensure compliance with data formats and invoice templates in accordance with Circular 78/2021/TT-BTC (implementation guidance for Decree 123).

- Large enterprises and corporations: Larger businesses often already have ERP systems or modern accounting software, so switching to e-invoicing is likely just an expansion of existing systems. This group is less impacted technically but must still strictly comply with detailed provisions of Decree 123. Due to issuing high volumes of invoices, large enterprises must pay attention to rules on tax codes, invoice reporting, handling incorrect invoices, etc. Corporate managers should monitor updates and amendments to Decree 123 (such as Decree 41/2022 and Decree 70/2023) to keep their policies current.

- Business households and individual traders: Although this group is not classified as “enterprises” under business law, large or frequent business households are also within Decree 123’s scope. Tax authorities are gradually incorporating business households into the e-invoicing system. Households with high revenue or under the tax declaration method must register to use tax-code-issued e-invoices for each sale. From 2025, under new regulations, some households may be exempt or temporarily suspended from e-invoicing if certain conditions are met, but overall, the trend is for all business entities to shift to e-invoicing for revenue transparency.

In short, every business—from small to large, in all industries involving goods and services—must pay attention to Decree 123. Retail and B2C service businesses, as well as traditional SMEs, need especially thorough preparation due to significant changes in invoicing practices. However, once transitioned, the long-term benefits include cost savings, time efficiency, error reduction, and more modern and effective business operations in the digital era.

Conclusion

Decree 123/2020/NĐ-CP on invoices and documents marks a significant step in the digital transformation of Vietnam’s accounting and tax sector. For small and medium enterprises, understanding the core content of the decree and identifying the required actions is key to ensuring legal compliance and avoiding unnecessary risks. More importantly, effective implementation of Decree 123 helps businesses legitimize all transactions, build transparency with customers, partners, and regulatory agencies.

Business managers should proactively study and stay updated on e-invoice regulations while investing appropriately in the technology systems needed for invoice creation and management. With proper preparation, businesses can turn compliance with Decree 123 into an opportunity for modernization, thereby enhancing operational efficiency and competitiveness in today’s digital business environment.