Menu

The adoption of e-invoicing not only enhances the efficiency of tax administration for government authorities but also opens opportunities for businesses to digitally transform their financial and accounting management.

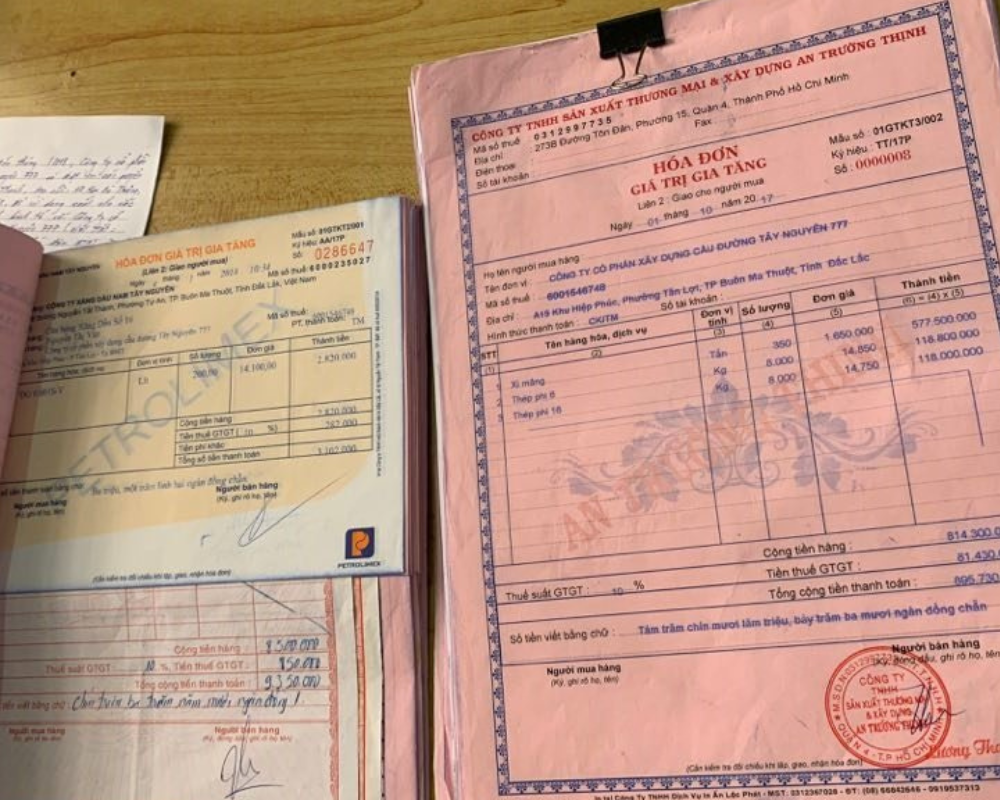

Currently, there are two main legally recognized forms of e-invoices:

- Traditional e-invoices – generated via invoicing software and digitally signed;

- E-invoices generated from cash registers – typically used at retail points of sale, with tax authority codes but without requiring a digital signature.

Choosing the appropriate form can have a direct impact on a business’s operational efficiency and cost.

Legal Basis and Current Regulations

Both forms of electronic invoices are legally recognized as valid. Decree 123/2020/NĐ-CP defines e-invoices as those that may or may not include a tax authority code, including those generated from cash registers connected to the tax authority’s electronic data system.

This means that e-invoices generated from cash registers are also considered tax-code e-invoices, differing only in how they are created.

According to the 2019 Law on Tax Administration and Circular 78/2021/TT-BTC, from July 1, 2022, all businesses and household businesses nationwide must adopt e-invoicing. For most businesses, the applicable format is traditional e-invoicing (with tax codes), except for some exempt cases where non-coded invoices are allowed.

Decree 123/2020/NĐ-CP (Article 11) introduced regulations for e-invoices generated from cash registers for the first time. Notably, such invoices do not require the seller’s digital signature. Despite this, they are still considered legally valid for tax reporting. In addition, the required content on cash register invoices is simplified.

Currently, using e-invoices from cash registers is voluntary, and businesses may adopt them if deemed suitable. However, the government is gradually mandating this form for specific sectors. Specifically, according to Decree 70/2025/NĐ-CP (effective from June 1, 2025), the following industries must use e-invoices generated from cash registers:

- Retail to end consumers: Businesses and individuals engaging in retail (e.g., shopping malls, supermarkets, direct-to-consumer retail outlets) with annual revenue >= 1 billion VND.

- Food & Beverage services: Restaurants, eateries, hotels.

- Passenger transport, arts, entertainment, and cinema services.

- Other personal services under the national economic sector classification (e.g., hair salons, karaoke, gyms, etc.).

Invoice Issuance Process: Traditional vs. POS

Although both formats are considered electronic invoices, their creation and data submission processes differ significantly due to technology and data transmission timing.

Traditional E-Invoices (via software):

- When a sale occurs, accounting staff or sales personnel generate invoices using e-invoicing software (e.g., MISA meInvoice, VNPT, Viettel, FPT, etc.).

- The invoice includes full details of the seller, buyer, goods/services, and applicable tax rates.

- The seller applies a digital signature using the company’s digital certificate.

- The invoice data is then sent to the tax authority in real-time for validation and issuance of a verification code.

E-Invoices Generated from POS Machines:

- At the point of sale (POS), such as cashier counters or retail stores, businesses use cash registers or POS systems integrated with e-invoicing capabilities.

- Each time a retail transaction occurs, the cash register automatically generates a tax-coded e-invoice and prints it (typically as a compact receipt, like those in supermarkets) to give directly to the customer.

- A key difference: tax authority codes are pre-issued in bulk for each cash register in advance, so there is no need to request a code for each transaction.

- Therefore, there is no need for a digital signature at the time of printing, and invoices can be issued instantly, 24/7, as customers make payments—without delays due to internet connection or system load.

- At the end of each day, the system transmits all invoice data in bulk to the tax authority via a certified data transmission service provider.

Investment and Operational Costs

Initial Setup Costs: For traditional e-invoices, businesses need a digital signature (USB Token or cloud-based signature), costing several million VND per year. They also need to purchase invoicing software or services from providers (e.g., MISA, VNPT, Viettel, FPT, CyberLotus). Pricing is often based on the number of invoices (via invoice packages) or a fixed annual fee. On average, this can be a few hundred VND per invoice depending on the package size. Businesses using ERP systems with integrated e-invoicing may have this cost bundled. No special hardware is required beyond a computer and printer (if physical printing is needed).

For e-invoices from cash registers, businesses may incur additional costs: investing in POS systems and receipt printers at the point of sale. If a POS system is already in place, only software upgrades may be needed to enable e-invoicing. Otherwise, new investments might include POS terminals, thermal printers, and invoicing software connected to the tax system. Many providers now offer integrated cash register solutions, sometimes with a one-time setup fee.

Invoice Usage Fees: In the long run, service fees for cash register e-invoices are similar to traditional ones, since both rely on intermediary transmission and electronic storage. In reality, cash register invoices are not more expensive. Providers offer flexible service packages. For example, a business may purchase a package of 10,000 invoices for around 300 VND/invoice, with smaller packages available for low-volume users. Concerns that the price could rise to 1,000 VND per invoice are unfounded. Thus, the per-invoice cost remains low for both formats.

Labor and Operational Costs: Cash register e-invoices are often more time- and labor-efficient than traditional formats. Cashiers can issue invoices immediately at the counter, while accountants process data once per day. Traditional e-invoices require real-time tracking, digital signing, and code approval for each transaction, potentially requiring extra staff or shifts outside regular hours. For high-volume retail businesses, cash register e-invoices reduce labor time and cost. For wholesale businesses with fewer invoices, the difference is minimal.

Businesses already using traditional e-invoices won’t incur major extra costs when switching to cash register formats—mainly POS hardware (if not yet available) and a stable internet connection at the point of sale. Annual maintenance fees for both formats are comparable. Businesses should consult with their e-invoicing providers to select optimal packages based on expected invoice volume.

Utility and Ease of Use

When choosing between traditional and cash-register-generated e-invoices, utility and user convenience are top considerations—especially for businesses in retail, F&B, direct services, or e-commerce.

Context Suitability: Traditional e-invoices suit formal, detailed transactions, such as B2B contracts. These invoices can be created remotely, emailed, and even scheduled in advance or issued in batches for regular clients. However, for retail and quick-sale environments, traditional e-invoices can be slow and cumbersome due to manual input, signing, and tax code processing—potentially leading to delays and a poor customer experience.

Cash register e-invoices address this gap. Invoices are printed instantly at the counter like conventional receipts, ideal for convenience stores, supermarkets, restaurants, and other high-volume retail settings. They still accommodate business clients when needed: staff can enter company names and tax codes before printing VAT invoices.

Processing Speed and Concurrent Service: A major benefit of cash register invoices is speed. They’re created, printed, and delivered in seconds—regardless of tax system status. If the tax system is offline, the POS still stores data for later submission. This uninterrupted service is crucial for busy businesses.

Multiple POS terminals can issue invoices simultaneously, helping to manage peak-hour traffic in places like supermarkets. This reduces cashier load and improves customer satisfaction.

Error Handling at Point of Sale: Errors (e.g., wrong product or quantity) are common in retail. With traditional e-invoices, correcting these requires formal adjustment procedures per Circular 78, including customer signatures. This is slow and complex. With POS invoices, errors can be canceled and reissued on the spot—provided data hasn’t yet been submitted. This enables flexible, professional service and reduces hassle.

Easy Lookup and Download: Cash register invoices often include QR codes linking to invoice data. Customers can scan the code to download a PDF or XML copy, useful for record-keeping or reissue. Traditional invoices also support lookups via tax portals but may require login credentials.

QR codes promote transparency and customer engagement. They support campaigns like the GDT’s “Lucky Invoice” program to encourage consumer participation and tax compliance.

Integration with Accounting and ERP Systems: Traditional e-invoices easily integrate with enterprise accounting systems via APIs. Revenues and taxes can be auto-posted upon issuance. For large companies using MISA, Bravo, Fast, etc., integration is smooth.

POS invoices are generated via POS systems, requiring syncing with accounting software. Many providers offer packages that consolidate POS and e-invoicing, allowing seamless end-of-day data transfers. Companies using bundled services benefit from easier control and faster syncing.

Regardless of format, ensuring timely and accurate invoice data transfer to accounting departments is key to avoiding revenue/reporting discrepancies.

Printing and Invoice Delivery

For traditional e-invoices, if customers need hard copies, businesses must print from PDF (typically A4 or A5). With cash register invoices, the printed receipt itself serves as the official copy—saving time and printing costs. Both formats have equal legal validity.

If customers request digital versions, businesses can send PDF files or links to the e-invoice portal, offering flexibility for archiving or verification.

Conclusion

In terms of convenience and functionality, cash register e-invoices are clearly superior for direct retail settings. With instant processing, operational resilience, error flexibility, and strong customer support, they’re ideal for retail, F&B, and service industries. Traditional e-invoices remain essential for complex B2B operations requiring control, integration, and long-term storage.

Many businesses now adopt a hybrid model—using both formats for speed and completeness. Based on business model, customer types, and internal processes, each company should assess and apply the most suitable solution—or run both in parallel to optimize performance while staying compliant with regulation