Menu

- Step-by-Step Process to Verify Input Invoice Validity

- Verify Seller Information

- Check Invoice Content and Format

- Validate Signatures and Seals (or Digital Signatures)

- Authenticate the Invoice Through the Tax Authority Portal

- Check the Timeframe for VAT Deduction

- Common Errors When Verifying Input Invoices

- Invoices Missing Mandatory Information

- Seller Information Is Invalid

- Missing or Invalid Invoice Authentication Codes

- Incorrect VAT Rates or Tax Calculations

- Duplicate Invoices

- Counterfeit Invoices

- Cash Payments for Invoices Over 20 Million VND

- Late Invoice Declarations

- Best Practices for Verifying Input Invoices to Minimize Risk

- Develop a Clear Internal Verification Process

- Regularly Train Accounting Staff

- Leverage Information Technology

- Prompt Verification and Contract Matching

- Retain Verification Evidence

- Periodic Supplier Legal Status Checks

- Strict Non-Cash Payment Compliance

- Stay Updated with Tax Policy Changes

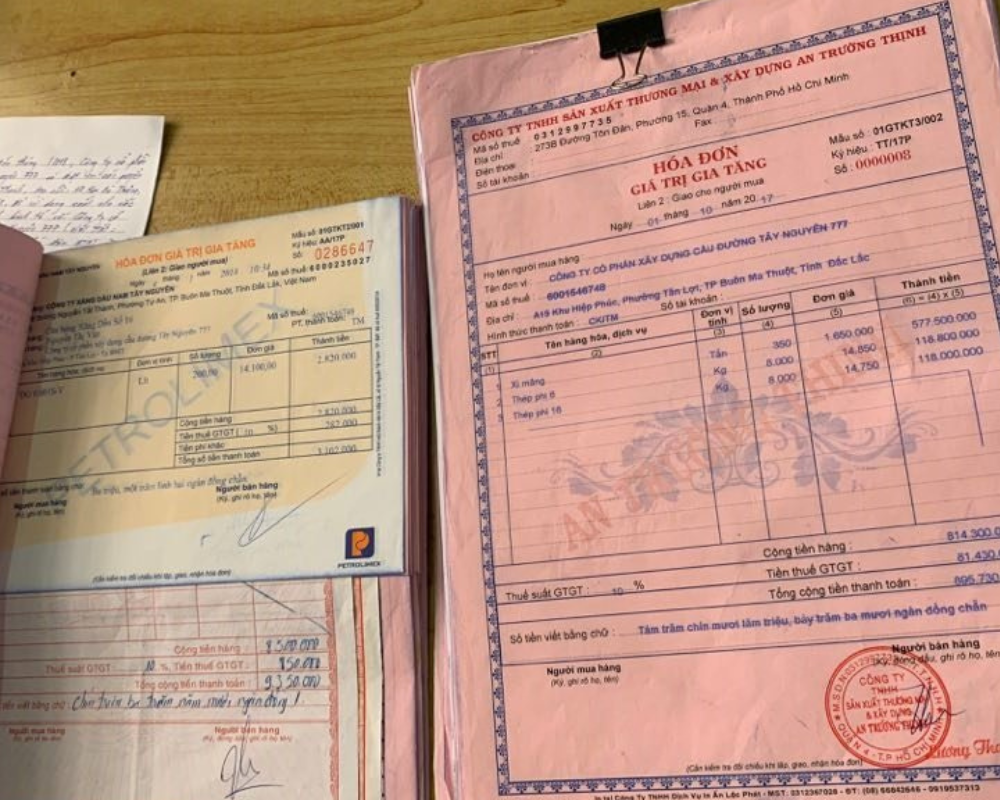

Input invoices serve as an important record of expenses incurred and forms the legal basis for calculating deductible input value-added tax (VAT). In other words, a purchase invoice is the legal proof allowing businesses to declare input VAT and deduct it from the amount payable.

Validating input invoices plays a crucial role in both tax and accounting management. A business can only claim input VAT deductions if the invoice is deemed valid and complies fully with legal regulations. The use of invalid invoices may result in disallowed deductions, additional tax liabilities, and penalties for tax violations. Furthermore, ensuring the validity of input invoices helps maintain accurate accounting records, prevents errors in financial statements, and minimizes risks during tax audits.

Step-by-Step Process to Verify Input Invoice Validity

To ensure that every input invoice received is compliant and legally valid, accounting departments must conduct a thorough and structured verification process. Below are detailed steps applicable for both traditional paper invoices and electronic invoices:

Verify Seller Information

First, cross-check the seller’s details on the invoice against actual records. Confirm the seller’s company name, address, and tax identification number (TIN). The TIN stated must accurately belong to the selling entity. It is advisable to verify the TIN through the tax authority’s system or the national business registration portal to ensure the seller’s legal status. If the seller has ceased operations, the TIN has been deactivated, or incorrect information is recorded, the invoice may be considered invalid.

Check Invoice Content and Format

Carefully review all details on the invoice to ensure they meet legal requirements. This includes verifying the invoice number, invoice symbol, invoice form code, issuance and signing dates (for electronic invoices); the buyer’s name, address, and TIN (your business); the description of goods/services, units, quantities, unit prices; applicable VAT rate and tax amount; and the total payment amount (in figures and words).

Validate Signatures and Seals (or Digital Signatures)

For paper invoices, a handwritten signature from the seller (typically the director or authorized representative) and a company seal (where applicable) must be present. Missing signatures or seals in mandatory cases will invalidate the invoice. For electronic invoices, the seller’s digital signature must be verified through the invoice file or XML data file. A valid e-invoice must bear a digital signature issued at the time of invoicing using a still-active digital certificate.

Authenticate the Invoice Through the Tax Authority Portal

This is particularly important for coded e-invoices. After verifying the invoice’s format and content, accountants should use the General Department of Taxation’s Invoice Portal (https://tracuuhoadon.gdt.gov.vn) to authenticate the invoice’s legality. The system allows for real-time validation by inputting key invoice information.

Check the Timeframe for VAT Deduction

It’s essential to confirm whether the invoice falls within the eligible period for VAT deduction. Under current regulations, there is no longer a strict six-month limit for declaring input invoices. Businesses can retroactively supplement and claim deductions within 10 years (per the Tax Administration Law) or at least before a tax audit decision is issued. However, in practice, tax inspectors only recognize deductions declared before inspection. Therefore, accountants should check invoice dates carefully against the current tax period. If an old invoice was missed, it should be promptly declared with a supporting explanation if necessary.

By following these five steps, businesses can effectively verify all legal aspects of input invoices—from confirming seller legitimacy and verifying invoice contents, to ensuring electronic authenticity and safeguarding VAT deduction rights. If an invoice passes all checks, it can be safely included in tax declarations and accounting records. If any discrepancies arise, corrective action must be taken before use.

Common Errors When Verifying Input Invoices

In the verification process, accountants may encounter a number of recurring issues. Recognizing these errors and knowing how to address them helps minimize risks. Below are common problems and recommended solutions:

Invoices Missing Mandatory Information

Some invoices may lack required details such as the seller’s TIN, address, or buyer/seller names, or may be missing signatures. Solution: Contact the seller immediately to issue an adjustment record or reissue a corrected invoice. Never manually alter invoices (e.g., by adding or erasing information), as this invalidates them legally.

Seller Information Is Invalid

If verification shows that the seller has ceased operations, absconded, or had its TIN deactivated before the invoice date, the invoice may be deemed unlawful. Using such invoices for VAT deductions may result in penalties. Solution: Immediately stop recording or declaring the invoice. Attempt to verify the seller’s status. If the seller is no longer operational, the invoice should be considered void and excluded from tax books (expenses can still be recognized without VAT deduction, provided there is proof of transaction). If invoice trading is suspected, report the matter to the tax authority.

Missing or Invalid Invoice Authentication Codes

For coded e-invoices, missing or invalid tax codes suggest that the invoice may not have been properly authorized. Solution: Request the seller to verify and, if necessary, reissue a properly coded invoice. Errors can occur when data submission to tax authorities fails but the invoice is still sent to the buyer.

Incorrect VAT Rates or Tax Calculations

Errors may occur, such as applying an incorrect VAT rate or miscalculating tax amounts.

Solution: Notify the seller and arrange for an official adjustment. Declare taxes based on the corrected figures. If mistakes were discovered post-declaration, submit an amended VAT return. Never alter invoice numbers without formal correction.

Duplicate Invoices

Due to system errors or mishandling, sellers may issue duplicate invoices. Solution: Identify duplicates during reconciliation, retain only one copy, and mark the other as canceled. Notify the seller.

Counterfeit Invoices

In the worst cases, businesses may encounter counterfeit invoices — falsified documents impersonating legitimate businesses or tax authorities. Solution: Do not use the invoice. Keep it as evidence and report to law enforcement or the tax office. Also, review procurement procedures.

Cash Payments for Invoices Over 20 Million VND

Cash payments for large transactions invalidate input VAT deductions. Solution: If paid in cash, record the transaction as a legitimate expense, but allocate the VAT amount to costs rather than claiming it as deductible.

Late Invoice Declarations

Sometimes, invoices from prior periods are overlooked. Solution: Supplement the declaration as soon as the omission is discovered. Laws allow retroactive deductions before inspection, but prompt action is crucial.

Best Practices for Verifying Input Invoices to Minimize Risk

To proactively manage risks, businesses should establish a formalized invoice verification process and maintain compliance in day-to-day operations. Here are key recommendations:

Develop a Clear Internal Verification Process

Create a formal guide for accountants to verify input invoices upon receipt. This should outline steps like receiving (electronic or paper), assigning responsible parties, verification criteria (e.g., TIN lookup, tax portal validation, digital signature checking), and evidence retention practices (e.g., screenshots of validation). A clear process ensures consistency across staff.

Regularly Train Accounting Staff

Accounting staff, particularly those handling payables and VAT reporting, must stay updated on the latest regulations such as Decree 123/2020, Decree 70/2025, and related circulars. Staff must know how to recognize legitimate invoices, conduct TIN and e-invoice verifications, and understand the implications of using invalid invoices. Training can include internal workshops or sessions organized by tax authorities.

Leverage Information Technology

Utilize accounting and invoice management software to automate verification. Digital tools reduce manual errors and save time. Maintain systematic archives of e-invoices (by month/quarter with backup copies) and digitize paper invoices for easy retrieval and cross-reference with payments.

Prompt Verification and Contract Matching

Verify invoices immediately upon receipt and cross-check against contracts or delivery notes. Address any discrepancies (e.g., quantity, price, tax rate) with the seller promptly. Delayed verifications can complicate corrections, especially after tax periods or if the seller becomes unreachable.

Retain Verification Evidence

After verifying invoices on tax portals, retain proof of validation (e.g., screenshots or printouts) alongside each invoice. For e-invoices, save both the XML original file and PDF display version, along with lookup information. This documentation is essential during audits.

Periodic Supplier Legal Status Checks

Regularly (e.g., quarterly) review the legal status of key suppliers. Detecting issues early, such as suppliers ceasing operations or being flagged by tax authorities, allows businesses to respond promptly and avoid risks from invalid invoices.

Strict Non-Cash Payment Compliance

Ensure all high-value contracts mandate payment by bank transfer. When receiving an invoice over 20 million VND, immediately check the payment method. If unpaid, promptly remind the buyer to transfer funds and keep proof of payment.

Stay Updated with Tax Policy Changes

As new regulations arise (e.g., Decree 70/2025 introducing new invoice forms like POS invoices), businesses must update their verification processes accordingly. Incorporate new risk control measures, such as validating suppliers against high-risk lists issued by tax authorities.