Menu

Introduction

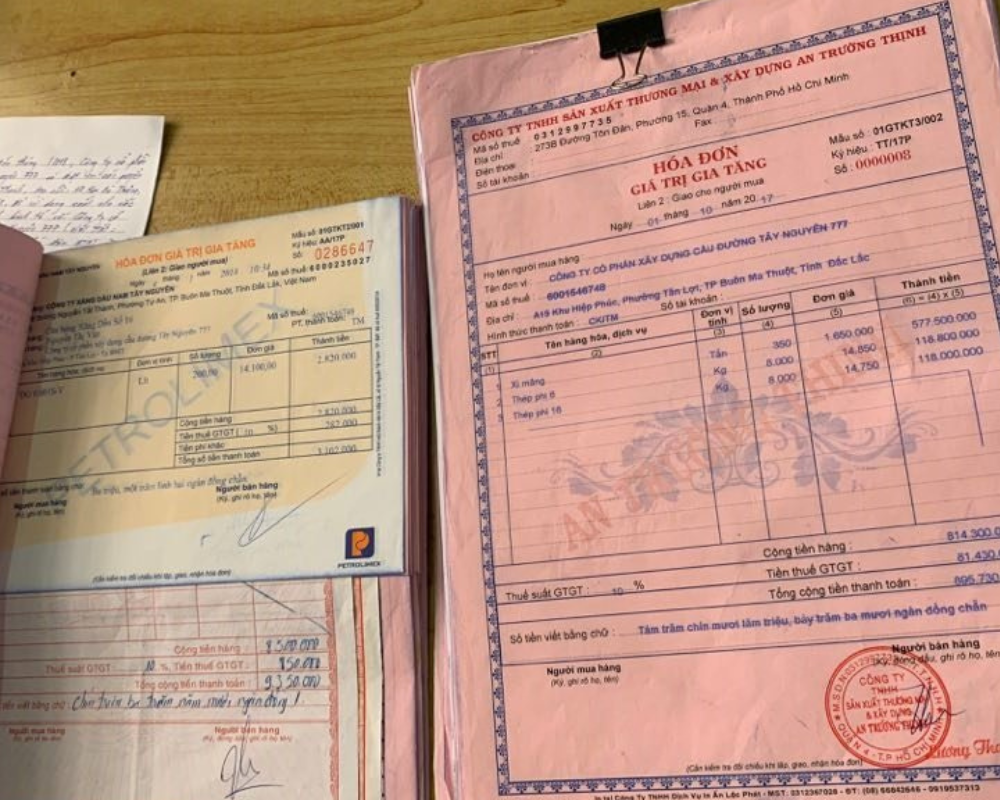

An invoice is more than just a payment document—it plays a critical role in tax reporting, customs clearance, and accounting, both in Vietnam and in the buyer’s jurisdiction. Even minor mistakes can lead to customs delays or cause the client to lose tax deduction eligibility, damaging both financial outcomes and reputations.

That’s why understanding the legal, formatting, and international invoicing conventions is essential. This article will walk through the key factors businesses should consider when issuing invoices for clients across multiple countries.

Legal Variations for International Invoicing

Every country has its own invoicing rules—ranging from formatting and required content to issuance processes and record-keeping. When engaging in cross-border transactions, Vietnamese businesses must not only comply with domestic regulations but also ensure their invoices are legally acceptable and valid in the buyer’s country. This becomes especially important if the client needs the invoice for VAT declaration or refund purposes.

Countries like Vietnam, Indonesia, the Philippines, and Malaysia (from 2024 onward) have mandated or are in the process of mandating e-invoicing to enhance transaction oversight and prevent tax fraud. In contrast, countries such as Singapore and Thailand are still encouraging a voluntary transition. As a result, invoice validation models differ: some countries adopt a “clearing” system—where invoices must be submitted to tax authorities for verification before being sent to the buyer—while others use a “post-audit” approach, where invoices are sent directly to the buyer and only reviewed later during periodic audits. Understanding these models helps businesses align their invoicing formats and issuance processes accordingly.

As for language and currency, most Southeast Asian countries require local language and local currency for domestic invoices. However, for international trade, invoices are generally accepted in English and in widely-used foreign currencies (such as USD, EUR, JPY), as long as the exchange rate and equivalent local currency amount are clearly stated. This is particularly important, as the converted amount is often used for VAT calculations, accounting entries, or customs declarations.

Standard Content and Format for for International Invoicing

Although requirements vary by country, a valid international commercial invoice should contain key elements that fulfill both legal obligations and practical needs for customs clearance, payment reconciliation, and accounting.

Essential information includes: the seller and buyer’s company names, addresses, and tax IDs or business registration numbers (where applicable); the invoice number and issuance date (with sequential, non-duplicate numbering); and clear descriptions of goods or services (including name, quantity, unit, unit price, and total amount). Descriptions must align with those on the contract, packing list, and bill of lading to ensure smooth logistics, customs clearance, and payment.

Additionally, invoices should state the agreed delivery terms (e.g., FOB, CIF, DDP based on Incoterms) and payment terms (e.g., T/T, Net30, or L/C). These details help define responsibilities for shipping, costs, and payment timelines. Invoices should also specify VAT/GST rates and amounts (if applicable) or indicate the exemption reason if zero-rated.

While invoicing in foreign currencies is common in international transactions, many countries require the invoice to show the applicable exchange rate and the converted amount in local currency. Including this information ensures that invoices are accepted by local authorities and makes it easier for buyers to comply with tax and accounting requirements.

Invoices are typically issued in PDF format and can include either electronic or manual signatures, depending on the buyer’s or bank’s requirements—especially for L/C payments. In jurisdictions with e-invoicing requirements, the invoice may need to follow structured data formats such as XML, JSON, or UBL for integration into tax and accounting systems. Some regions—such as the EU and Singapore—support Peppol networks, which facilitate international e-invoice exchange using a unified format.

The use of digital signatures is also becoming increasingly common—and mandatory—in many countries to ensure authenticity and prevent fraud. Vietnamese companies issuing e-invoices internationally should use a digital signature that is either internationally recognized or accepted by the recipient’s local standards to maintain legal enforceability.

Foreign Currency and Exchange Rate for International Invoicing

Some countries have specific rules about the type of exchange rate to be used—such as the central bank rate, customs rate, or market rate—and the date the rate applies (e.g., invoice date, shipment date, or payment date). Businesses should clarify these details in advance with their partners and clearly indicate the reference rate on the invoice or contract to avoid misunderstandings.

Best practice is to explicitly list the currency code (USD, EUR, JPY, etc.) and include the exchange rate and local currency equivalent if required. Doing so not only ensures regulatory compliance in the importing country but also facilitates accurate tax filing and accounting for the buyer. It also helps mitigate currency risk during the payment process, especially when there is a time lag between invoicing and settlement.

By aligning on exchange rates at the start, both parties benefit from clearer debt reconciliation, fewer disputes, and a stronger, long-lasting business relationship.

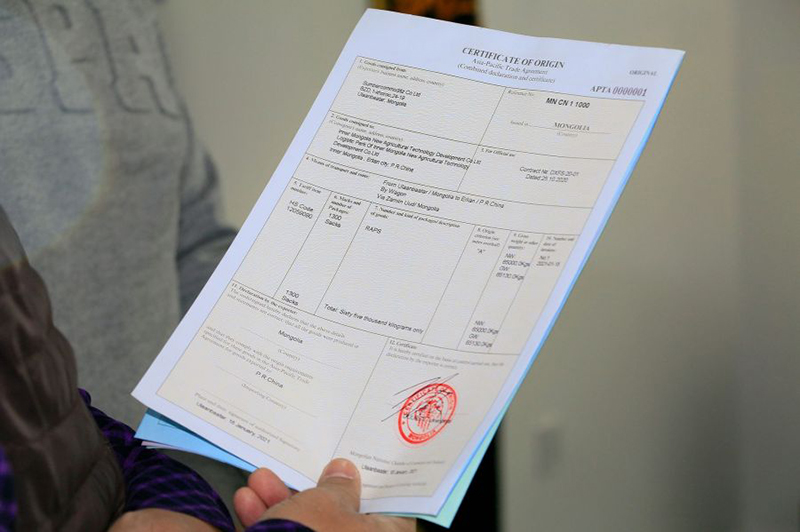

Supporting Documents for International Invoicing

In export transactions, commercial invoices are typically accompanied by a set of supporting documents required for logistics, customs clearance, and payment processing. The key is consistency across all documents.

The invoice should match the bill of lading or airway bill in terms of sender, recipient, and product descriptions. It should also align with the packing list regarding item quantities and specifications, which facilitates inspections by customs and buyers. The export declaration must reflect the invoice values and shipping terms accurately. If a certificate of origin (C/O) is included, product descriptions and values should match to ensure eligibility for tariff benefits.

When payment is made via letter of credit (L/C), the invoice is one of the most critical documents and must strictly comply with the terms of the L/C—from beneficiary details to item descriptions and total value. Even small discrepancies can result in the bank rejecting the payment.

To prevent issues, businesses should use a comprehensive checklist to verify consistency across all documents before submission. This step ensures smoother customs processing and faster payment turnaround.

Practical Advice on Exporting, Payments, and Reconciliation

Vietnamese exporters should proactively research invoicing requirements specific to each country and customer. Pre-confirming information like VAT numbers (in the EU), bilingual invoice needs (in Japan), or internal purchase order references (PO numbers) can reduce errors and avoid the need to reissue invoices.

Invoices must clearly state payment terms, currency, and exchange rates when relevant. For long-term contracts, consider including price adjustment clauses to protect against currency volatility. In international payments, marking “Bank charges: OUR” on the invoice ensures that the seller receives the full payment amount.

It’s also important to retain e-invoices as per legal requirements and be prepared to provide printed copies if requested. Monitoring remittance fees and exchange rate fluctuations during the payment window is recommended. Regular account reconciliation helps detect discrepancies early—whether due to banking fees or rate changes—and supports sound cash flow management.

Understanding the local tax rules—such as the “Reverse Charge” system in the EU or HSN codes in India—not only helps your clients but also demonstrates professionalism. Finally, stay up-to-date with evolving invoicing policies in key export markets (such as CEI in the Philippines or InvoiceNow in Singapore) to ensure seamless operations and maintain strong global partnerships.

Conclusion

Issuing international invoices is a critical step in the export process, directly impacting delivery timelines and payment completion. In today’s increasingly digital and regulated environment, Vietnamese businesses must take invoice management seriously—covering everything from content creation and formatting to issuance, record-keeping, and reconciliation.

A professionally prepared, accurate, and internationally compliant invoice not only streamlines client operations but also signals the credibility and capability of Vietnamese businesses on the global stage. With Southeast Asia embracing mandatory e-invoicing and digital transformation, this is a valuable opportunity for local enterprises to modernize workflows, reduce costs, and tap into standardized systems to enhance trade efficiency worldwide.