Menu

- What is Decree 123/2020/NĐ-CP?

- Common Violations Related to E-invoices and Documents

- 1. Delayed invoice issuance (Incorrect timing)

- 2. Incorrect invoice content or formatting (Wrong type, wrong info)

- 3. Not issuing invoices for sales or services

- 4. Illegal use or trading of invoices

- 5. Violations in invoice management, storage, and cancellation

- How to Avoid Violations

- Conclusion

From July 1, 2022, most businesses are required to implement e-invoices in compliance with Decree 123. Failure to follow these regulations may result in serious violations and heavy penalties. This article aims to help businesses understand Decree 123, identify violations related to e-invoices and accounting documents, learn about corresponding fines, explore real-life examples, and adopt best practices to stay compliant.

What is Decree 123/2020/NĐ-CP?

Decree 123/2020/NĐ-CP was issued by the Government on October 19, 2020, providing detailed guidance on invoices and documents used in business activities. The decree officially took effect on July 1, 2022, and replaced older regulations related to paper invoices (Decrees 51/2010/NĐ-CP and 04/2014/NĐ-CP) as well as those on e-invoices (Decree 119/2018/NĐ-CP).

Decree 123 has a wide scope of application, including:

- E-invoices: All types of invoices such as VAT invoices, sales invoices, e-invoices with or without tax codes, and special invoices (e.g., invoices for selling public assets or national reserves) are covered under this decree.

- Supporting documents: In addition to invoices, the decree also covers specific documents like internal delivery slips and consignment delivery notes, used when goods are circulated internally without invoice issuance.

Common Violations Related to E-invoices and Documents

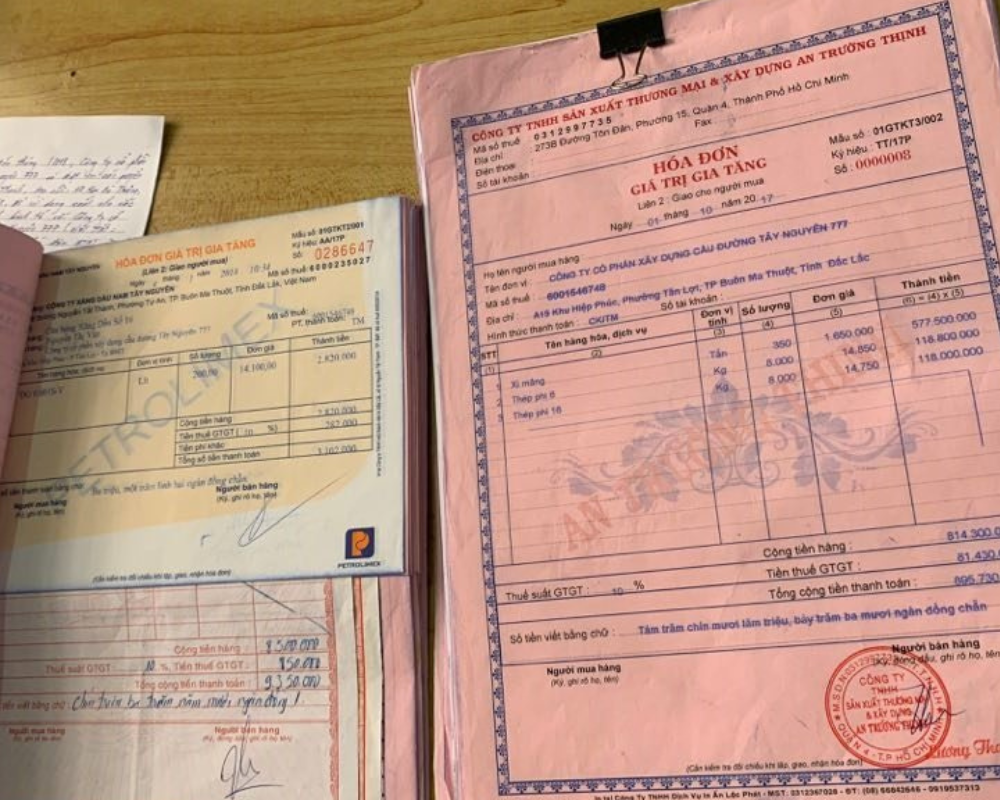

Current regulations strictly prohibit many actions involving invoices and accounting records. For example, the Law on Tax Administration bans selling goods or services without issuing invoices, as well as using illegal or invalid invoices. Below are common violations under Decree 123 and applicable penalties:

1. Delayed invoice issuance (Incorrect timing)

Businesses must issue invoices at the time of transaction or within the allowed timeframe (e.g., by end of day for retail). If invoices are issued late—such as several days after goods have been delivered—it constitutes a timing violation.

Fines depend on the tax impact. If the delay doesn’t affect tax declarations (e.g., still declared in the correct tax period), fines range from VND 3,000,000 to 5,000,000. If the delay results in wrong tax periods or tax payment delays—or is found during inspection—fines increase to VND 4,000,000 to 8,000,000.

2. Incorrect invoice content or formatting (Wrong type, wrong info)

E-invoices must comply with required templates and content rules. Common violations include:

- Issuing the wrong type of invoice: For example, issuing a regular sales invoice instead of a VAT invoice, or using a non-coded invoice when a coded one is required by tax authorities.

- Mistakes in invoice details: Such as incorrect tax rates, wrong buyer tax codes, product/service descriptions, or missing mandatory fields.

- Using the wrong template or wrong order: Such as editing the invoice format without approval, or issuing invoices out of sequence. Invoices dated before official issuance approval are also serious violations.

These violations typically incur fines from VND 4,000,000 to 8,000,000 per instance. In minor cases where errors are detected and corrected promptly before a tax inspection (e.g., both parties detect and correct a wrong invoice type), only a warning or smaller fine may apply. However, if tax declarations are affected, businesses may face back taxes and additional tax penalties.

3. Not issuing invoices for sales or services

This is among the most serious violations. Failing to issue invoices when selling goods or providing services often indicates intent to evade taxes. The Law on Tax Administration strictly prohibits such behavior.

Under Decree 123 (and Decree 125), the administrative fine for each failure to issue invoices ranges from VND 10,000,000 to 20,000,000. If the violation leads to tax evasion, tax authorities may impose extra penalties based on the evaded amount (from 1 to 3 times the tax due) in accordance with tax evasion regulations.

4. Illegal use or trading of invoices

Illegal invoices include counterfeit invoices, unregistered invoices, expired invoices, or invoices traded unlawfully. Even legitimate invoices used improperly—such as lending them to others to legalize false transactions—are also violations.

One serious offense is the unauthorized sale of invoices, where one party sells invoices to another to help fabricate transactions and evade taxes. Such actions are usually organized and face strict penalties.

According to Decree 125/2020/NĐ-CP, penalties for using or trading illegal invoices range from VND 20,000,000 to 50,000,000. All invalid invoices will be canceled, and violators must return any illegitimate profits. In severe cases—especially involving bulk invoice trading—criminal charges under Article 203 of the Penal Code may apply.

5. Violations in invoice management, storage, and cancellation

Businesses are required to manage and store invoices correctly. Common issues include:

- Lack of documents for internal goods transfer: Moving goods between warehouses or to agents without appropriate supporting documents (e.g., internal delivery slips) is a violation. If caught, the goods may be temporarily seized and fines applied, similar to invoice omissions.

- Lost or damaged invoices: If invoices are lost or damaged and not reported promptly, businesses can be fined up to VND 8 million, depending on severity. For e-invoices, data loss that cannot be recovered is treated similarly.

- Failure to cancel remaining paper invoices: When switching to e-invoicing, businesses must cancel unused paper invoices on time. Failing to do so—or following incorrect procedures—may result in fines up to VND 8 million.

- Delayed submission of e-invoice data: Businesses must submit e-invoice data (especially for non-coded invoices) to tax authorities on time. Late submissions incur fines from VND 2 million to 5 million, with repeat offenses subject to higher penalties.

How to Avoid Violations

To minimize risks and ensure compliance, businesses should keep the following key points in mind when applying Decree 123:

- E-invoicing has been mandatory since July 1, 2022. Businesses that haven’t properly implemented it are considered in violation and face tax-related risks.

- Every transaction must be accompanied by a valid invoice—even for promotional giveaways, gifts, or low-value sales.

- Absolutely avoid using, renting, or trading invoices illegally. These practices are easily detected by tax authorities and subject to heavy penalties, including potential criminal prosecution in serious cases.

- Invoice information must be completely accurate. Even small errors, if not corrected in time, may result in expense deductions being denied or administrative fines.

The modern tax system enables close monitoring of transactions. Abnormal revenue patterns, excessive invoice issuance, or signs of invoice trading can all trigger audits or investigations. Strict compliance with Decree 123 is not only a legal responsibility but also a foundational element for businesses to build trust, improve operational efficiency, and grow sustainably in the digital age.

Conclusion

Decree 123/2020/NĐ-CP marks a significant advancement in creating a transparent and modern business environment through the use of electronic invoicing. Businesses must understand the regulations, identify potential risks, and be proactive in complying. Invoice-related violations don’t just cause financial losses—they also damage a business’s reputation. Legal compliance is not merely an obligation but a critical step toward long-term success and digital transformation.