Menu

- What is an Input Invoice?

- Types of Input Invoices

- Role of Input Invoices for Businesses

- In Financial Accounting

- In Tax Management

- In Internal Business Management

- In Legal Context (Compliance and Protection)

- Best Practices for Managing Input Invoices Effectively

- Common Errors in Handling Input Invoices

- Conclusion

Input invoices may seem like minor documents, but they hold great significance for every business. From small to medium and large companies across all sectors, input invoices are present in almost every purchasing and spending activity. Understanding the definition, classification, and role of input invoices helps businesses manage finances more effectively and stay legally compliant.

This article provides a user-friendly, easy-to-understand overview of input invoices, along with real-life examples and guidance on how to manage them efficiently.

What is an Input Invoice?

An input invoice is a type of invoice that a business receives from a seller when purchasing goods or services. In other words, it is a document issued by the seller to prove that the buyer has purchased goods or services. Input invoices typically contain full information about the seller, buyer, goods/services, amounts, tax rates, date, etc. When your company purchases anything for business purposes (e.g., raw materials, goods, outsourced services, office supplies, utilities…), the document confirming that transaction is your input invoice.

Example: Company A, which manufactures furniture, buys 100m³ of wood from supplier B. After the transaction, company B issues an invoice to company A clearly stating: type of wood, quantity of 100m³, unit price in VND per m³, total price, 10% VAT, and the invoice date. Company A receives this invoice and keeps it for accounting the wood expense. In this case, the invoice from company B is an input invoice for company A. This invoice serves as a valid document to record the wood material expense and as a basis for VAT deduction (if applicable) for the tax reporting period.

Input invoices play a vital role in accounting and tax management. Specifically, they serve as the basis for recording expenses, calculating deductible taxes, and settling taxes with the authorities. Additionally, the information on input invoices helps analyze business expenses and supports decisions on pricing, budget allocation, and business strategies.

Types of Input Invoices

Input invoices can be categorized by tax characteristics and format. Below are key classifications businesses should be aware of:

By type (based on tax):

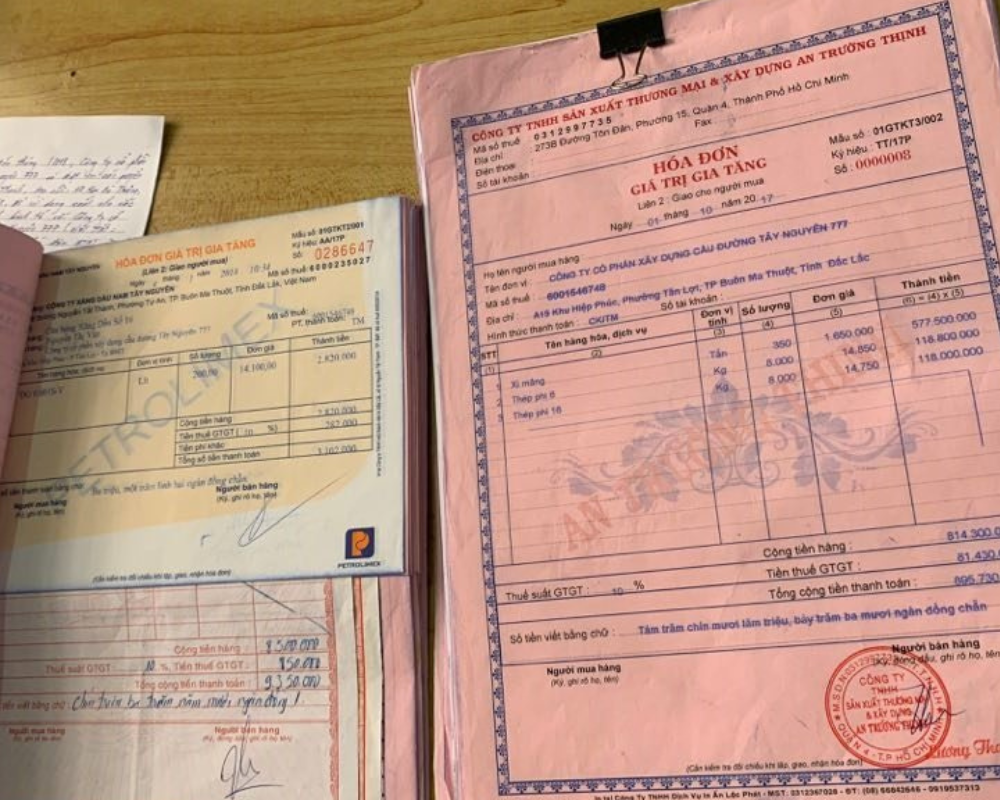

- Value-Added Tax (VAT) Invoices (commonly called “red invoices”): This is the most common type of invoice for businesses using the credit method for VAT declaration. These are issued based on templates provided by the Ministry of Finance and explicitly show the VAT amount. Buyers can claim VAT credits for taxes paid on goods or services.

- Sales Invoices: Used by entities not eligible for VAT credit, such as those using the direct tax method or small business households. These invoices don’t show VAT rates (because taxes are calculated as a percentage of revenue or are exempt from VAT).

- Specialized documents considered invoices: Including transport tickets, receipts for banking services, and service fees. Though different in format, they are still considered legitimate invoices for accounting.

By form and issuance method:

- E-invoices: Now mandatory and most common in Vietnam, e-invoices are digital data messages created and stored on computer systems. They replace physical paper and carry the seller’s digital signature. Invoices are received via email, online portal, or download links.

Example: Your office supply vendor sends a PDF/XML invoice via email – this is your electronic input invoice. - Paper invoices: Previously used before the e-invoice rollout, they could be pre-printed (approved templates) or self-printed (via software). While no longer allowed for new issuance under Decree 123/2020/NĐ-CP, businesses may still encounter paper input invoices from older transactions or special cases. These remain valid if issued properly. Original copies must be stored for accounting purposes.

Whether VAT or sales invoices, electronic or paper, input invoices all serve the same purpose: documenting the business’s purchases. Understanding the types helps accountants record and declare them correctly, while enabling managers to control costs effectively.

Role of Input Invoices for Businesses

Input invoices impact many critical areas of a business, including financial accounting, tax management, internal control, and legal compliance.

In Financial Accounting

Input invoices are the primary basis for expense recognition and financial control. Each one reflects a payable expense, meaning:

- Cost Accounting: Input invoices provide essential details for accounting expenses: what was purchased, why, when, and for how much. Only documented expenses are valid in profit and loss statements.

- Valid Accounting Documents: According to accounting laws, invoices are legitimate documents for bookkeeping and financial reporting if they include all required details (names, addresses, tax IDs, item descriptions, dates, digital signatures, etc.). Missing or invalid invoices cannot be used in records, risking disqualification of the related expenses.

- Payables and Cash Flow Management: Input invoices indicate amounts owed to suppliers (unless prepaid). Accountants track payment deadlines and manage cash flows accordingly. Conversely, if payment is made upfront, the invoice confirms entitlement to the goods or services. Reviewing invoices also helps evaluate actual versus budgeted spending.

In Tax Management

Input invoices are vital in tax compliance and optimization:

- VAT Deduction: For businesses using the credit method, VAT invoices are the basis for claiming input VAT deductions.

- Tax Declarations and Settlements: All input invoices must be declared in monthly or quarterly VAT returns. Valid invoices also support Corporate Income Tax (CIT) deductions. Tax authorities may cross-check input invoices with seller records, and anomalies (e.g., fake invoices) can result in tax recovery and penalties.

- Legal Compliance: Businesses must adhere to tax laws regarding input invoices, including rules for non-cash payments for large-value purchases to be eligible for VAT deduction. Understanding and following these rules avoids legal issues and optimizes tax obligations.

In Internal Business Management

Input invoices help improve internal controls and transparency:

- Cost and Budget Control: Categorized input invoices allow managers to monitor spending versus budgets, flag unusual expenses, and adjust policies.

- Cash Flow Transparency: Each invoice documents a money-out transaction, giving a clear view of how funds are used—especially important for large enterprises with complex flows.

- Fraud Prevention: Requiring invoices for reimbursements discourages employees from inflating or falsifying expenses. The accounting team can also detect anomalies through invoice checks.

- Business Analytics: Over time, invoice data can be used to analyze costs (e.g., raw material ratios, marketing ROI) to inform strategic decisions.

In Legal Context (Compliance and Protection)

Input invoices are legal proof of business transactions:

- Transaction Evidence: In case of disputes, a valid invoice (with a signature or seal) serves as the first piece of evidence.

- Regulatory Compliance: Incorrect or fraudulent use of invoices can result in fines or even criminal charges. Loss of invoices may also lead to penalties.

- Legal Rights Protection: Valid input invoices support claims in audits and protect the company from arbitrary tax assessments. They’re also used for warranties and insurance claims.

Best Practices for Managing Input Invoices Effectively

Effectively and systematically managing input invoices can help businesses save time, avoid errors, and reduce legal risks. Below are key tips and best practices:

Receive and check invoices immediately upon receipt

Each time your business purchases goods or services, make sure to request an invoice at the time of payment or delivery. Once the invoice (electronic or paper) is received, check its validity before accepting it. Items to check include: company name, address, tax ID, accurate item and amount details, correct VAT rate, digital signature or signature and seal of the seller, invoice date matching the transaction, and presence of a tax authority code (for e-invoices).

Early checks help detect errors, allowing you to request corrections or replacements promptly. Delayed error detection can complicate tax declarations.

Organize invoices in a structured system

After verification, store invoices systematically. For e-invoices, store XML and PDF files on your computer or in the cloud, with backup copies to prevent data loss. Some companies also print copies for easier reference. For paper invoices, keep original copies (carbon copy No. 2) in files sorted by date, vendor, or expense type.

The accounting team should maintain an input invoice logbook noting date, number, vendor, and value for traceability. According to accounting laws, all invoices used for bookkeeping or financial reports must be stored for at least 10 years. Ensure paper invoices are protected from moisture and loss; secure e-invoices with proper backups.

Use e-invoice management software

Many tools today offer automated and efficient e-invoice management. Businesses should take advantage of these systems to reduce manual work and minimize errors.

Features may include: auto-data extraction from invoice files into accounting systems, comparison of invoice data with warehouse receipts, or fraud alerts (e.g., seller’s tax ID flagged by tax authorities).

Invoice lookup can also be filtered by vendor, date, or invoice number. Some tools also integrate with tax portals, ensuring timely and complete declaration.

Meet legal payment conditions for tax compliance

As mentioned earlier, invoices over VND 20 million must be paid by bank transfer to be eligible for VAT deductions. From 2025 onward, this requirement extends to invoices under VND 20 million. To comply, set internal policies: pay by bank transfer for all qualifying purchases and keep payment proofs (e.g., bank statements) attached to invoices. This ensures invoices meet both formal and tax-related requirements.

Track tax declaration deadlines for invoices

Input invoices are only eligible for VAT deduction if declared on time. Current regulations require businesses to declare input VAT invoices in the same tax period (month or quarter) in which they arise.

If missed, supplementary declarations are allowed but should be minimized to avoid audit flags. Best practice: declare invoices in the month they’re received. Keep a tracking sheet to record which invoices have or haven’t been declared, especially during year-end audits. On-time declaration helps businesses promptly benefit from tax deductions and avoids hassle later.

Train staff and set internal workflows

Train employees—especially purchasers, cashiers, and accountants—on the importance of input invoices and related regulations. Set internal rules such as:

- Always collect an invoice after purchase

- Forward e-invoices received via shared emails to the accounting team immediately

- Do not process payments without a valid invoice

- Reconcile received goods with invoices regularly (weekly/monthly)

Also, assign clear responsibilities: who stores e-invoices, who manages paper archives, who checks validity, etc., to ensure no task is overlooked.

Common Errors in Handling Input Invoices

Even companies with proper systems can encounter errors related to input invoices. Below are common mistakes and solutions:

Invalid or fake invoices

This is serious but not uncommon. For instance, a vendor may issue an invoice that lacks required details or worse—provide a fake one.

Using fake or invalid invoices can result in severe penalties and disallowance of expenses and tax deductions.

Solution: Always validate invoices (check the tax ID against the tax authority’s database, verify digital signatures, etc.). If a fake is suspected, request clarification or a new invoice. If already booked, report the issue to tax authorities and exclude the invoice from declarations to avoid fraud accusations.

Only work with reputable vendors and avoid black-market “invoice selling” services, which are illegal.

Paying cash for large-value invoices

If your business pays in cash for invoices over VND 20 million, those invoices will not be VAT-deductible and may not be counted as deductible CIT expenses.

Solution: If already paid in cash, book the expense but do not deduct VAT. For future transactions, always agree on bank transfers for high-value purchases. Establish internal thresholds (e.g., mandatory transfers for anything above VND 20 million) and ensure your company has a bank account to facilitate compliant transactions.

Lost invoices (misplaced or damaged)

Paper invoices can be lost or damaged without proper storage. E-invoices may be lost if not backed up. Missing invoices lead to gaps in documentation and potential fines.

Solution: If a paper invoice is lost, prepare a report with the vendor and notify the tax authority. The vendor may issue a certified copy or data record.

For e-invoices, vendors can usually resend the file or you can re-download it if you know the lookup code.

Prevention is key: backup all invoices (digital and physical) and maintain a searchable tracking list.

Missed or mistimed declarations

This happens when an invoice isn’t declared in the correct tax period or is omitted altogether. This could result in lost tax deductions or require an amended tax return.

Solution: If an invoice is missed, include it in the next declaration (as long as it’s before a tax inspection notice is issued).

Prevent this by reconciling invoices monthly with purchase records and checking emails to avoid missed entries. Invoice management software can also send reminders.

Invoice details errors

Sometimes invoices have minor errors (e.g., wrong address, tax ID, item descriptions, or quantities). Ignoring these can cause reconciliation issues or tax rejections later.

Solution: Contact the seller immediately to issue a correction or replacement invoice. Even small mistakes (e.g., tax ID typos) render the invoice invalid. Timely corrections preserve the invoice’s legality and allow for proper use.

Conclusion

Though they may appear as just paper slips or files, input invoices serve as the backbone of financial management and legal compliance in any business. From cost recognition and tax deductions to internal control and legal protection, input invoices play a quiet yet vital role.

We hope this article has helped you clearly understand what input invoices are, how they’re classified, and the many roles they play in accounting, taxation, internal operations, and legal matters. Apply the practical tips provided to manage your input invoices effectively—helping your business operate transparently, sustainably, and successfully.