Menu

This journey has been marked by three major legislative milestones, each representing a significant phase in the development of invoice regulation. This article offers a detailed comparative analysis of Decree 123/2020 in relation to the earlier Decrees 51/2010 and 119/2018. It highlights the key differences in policy orientation, scope, application, and impact on enterprises—especially small and medium-sized businesses. Additionally, the article outlines the broader transition process from manual to digital invoice systems and explores the legal, technical, and economic implications of these regulatory shifts on Vietnam’s business environment.

Context and Objectives of Each Decree

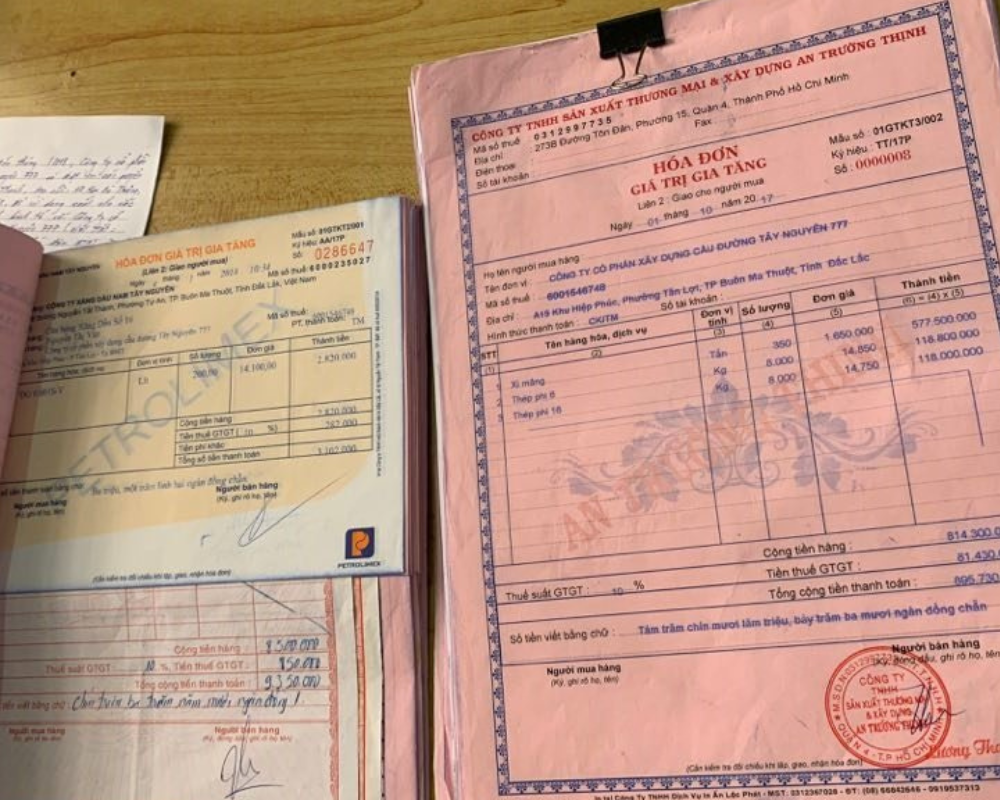

Decree 51/2010/NĐ-CP (2010): Issued in the context of tax administrative reform, Decree 51 marked a breakthrough in invoice management. Before that, businesses were typically required to purchase invoices issued by the tax authority. Decree 51 was introduced to grant autonomy to enterprises in creating and issuing their own invoices. Businesses could print or outsource invoice printing to suit their needs, in line with a market-oriented economy and new laws (Law on E-Transactions, Law on Tax Administration). Its objective was to reduce administrative procedures, simplify invoice issuance, allow businesses to design their own invoice templates and take full responsibility for their invoices—thereby reducing the management burden for tax authorities. (The decree also emphasized improving the provision of information on implementing invoice regulations for the sale of goods and provision of services.)

Decree 119/2018/NĐ-CP (2018): Eight years after Decree 51, the government issued Decree 119 to promote the transition to e-invoices. The context for this was the advancement of digital technologies, the demand for greater transparency, and efforts to combat tax fraud. The persistent use of fake paper invoices and the buying/selling of invoices necessitated a more modern solution for efficient invoice management. Decree 119 aimed to popularize e-invoices in sales and service activities, gradually reduce paper invoice use to save costs and prevent fraud. It also aimed to build a centralized invoice database managed by tax authorities to track business transactions in near real-time, thus improving the effectiveness of tax administration.

Decree 123/2020/NĐ-CP (2020): Issued on October 19, 2020, Decree 123 replaced both Decree 51 and Decree 119 in response to new requirements from the 2019 Law on Tax Administration (Law No. 38/2019/QH14) and the practical rollout of e-invoicing. Its objective was to consolidate all regulations on invoices and documents into a single decree, providing a unified legal framework for e-invoices and e-documents. Decree 123 also expanded the scope of applicable entities, introduced new invoice types, and delayed the mandatory deadline for e-invoice usage to July 1, 2022, to allow more time for transition. In other words, Decree 123 both inherited the modernization goals of Decree 119 and made adjustments to suit real-world implementation, ensuring smoother compliance for all stakeholders.

Scope and Applicable Entities

While all three decrees address invoicing, their scope and target audiences vary according to the policy priorities of each period:

Decree 51/2010: Regulated the printing, issuance, and use of invoices for the sale of goods and services (including VAT invoices, sales invoices, and other invoice types) within the economy. It applied to all organizations and individuals engaged in the sale of goods and services within Vietnam. Decree 51 required both businesses and individual business households to use invoices when selling (except for some low-value retail cases). However, eligible businesses could self-print/order invoices, while small traders and individuals without sufficient capacity could obtain tax authority-issued invoices (i.e., purchase printed invoices).

Decree 119/2018: Focused specifically on e-invoices used in the sale of goods and provision of services. Applicable entities included businesses, economic organizations, households, and individual traders required to transition to e-invoices under a phased roadmap, along with tax authorities and e-invoice service providers. The scope of Decree 119 no longer addressed paper invoices (which were covered under Decree 51) but instead focused on provisions for the creation, transmission, receipt, storage of e-invoices, and responsibilities of related parties.

Decree 123/2020: Provided a comprehensive regulatory framework for both invoices and related documents. Its scope includes e-invoices, paper invoices printed by tax authorities, and expanded to cover additional types of electronic tax-related documents. The applicable subjects, beyond businesses, organizations, and individual traders like Decree 119, also include government agencies issuing electronic receipts for tax/fee collection, and organizations authorized to issue invoices, as well as e-invoice service providers. In other words, Decree 123 takes a more comprehensive approach—any entity using invoices or documents must comply with this decree.

Impact on Businesses

Changes in invoice policies have had a direct impact on the business community. Each transitional phase brought both advantages and challenges, particularly for small and medium-sized enterprises (SMEs):

Decree 51/2010 Period: The greatest benefit for businesses was autonomy. Enterprises were no longer dependent on tax authorities to purchase invoice books, but could print as needed, avoiding business disruptions caused by invoice shortages. Custom-designed invoices also enhanced brand image.

However, for smaller businesses, self-printing could be a burden—they needed printers, had to order large print batches (despite low usage), and navigate complex issuance procedures. Many micro-businesses and household businesses preferred to buy tax-issued invoices to reduce costs and paperwork, despite limitations (buying by booklet, needing to repurchase frequently). Overall, Decree 51 increased upfront responsibility and costs (printing, managing, storing paper invoices) for businesses, but gradually reduced tax authority interference in daily operations.

Decree 119/2018 Period: For many businesses—especially SMEs—the mandatory e-invoice regulation marked a significant and initially challenging shift. Enterprises had to invest in technology infrastructure: computers, digital signatures, software, or contracts with e-invoice service providers. The initial implementation and employee training costs were not insignificant, especially for businesses unfamiliar with accounting or management software. Additionally, early concerns about the security and legality of e-invoices (e.g., data loss, unfamiliar digital processes) were common. For household and individual businesses—many of which are small-scale—the adoption of e-invoices exceeded their capabilities (they were used to manual bookkeeping and lacked computer literacy).

Hence, Decree 119 introduced a transitional phase to allow time to adapt and encouraged tax authorities to provide support. In practice, tax offices partnered with providers to offer free installations and training for newly transitioning businesses. Some small businesses and traders in disadvantaged areas were even granted free e-invoice usage for 12 months. Despite initial challenges, e-invoices brought long-term benefits: cost savings on printing and storage, elimination of lost invoices, faster customer delivery via email, and shorter payment cycles. These advantages gradually convinced even small enterprises to join the shift.

Decree 123/2020 Period: Thanks to the delayed mandate to July 1, 2022, most businesses had more time to prepare, reducing negative impacts. By the time Decree 123 was rolled out, many small businesses were already familiar with the concept of e-invoices (partly due to awareness efforts from 2018–2020). Tax authorities also launched a national e-invoice portal and allowed businesses to use it for free—an option especially helpful for those not ready to go through third-party providers. This significantly reduced costs for small businesses, as they could issue invoices directly on the tax system without buying software.

On the other hand, since all invoices were connected to the tax authority, small businesses could no longer hide revenue easily—they were now expected to transparently report sales and pay taxes accordingly. In terms of benefits, with all invoicing procedures digitized, small businesses no longer had to visit tax offices to purchase invoices or submit paper reports, saving time and manpower. In general, although Decree 123 mandated a universal transition, it created favorable conditions (technical support, initial free tools) for SMEs to participate—thus enabling them to benefit from a more modern and fair business environment.

Advantages, Challenges, and Notable New Features

Key Advantages and New Features:

- Consolidation and Expanded Scope: Decree 123 combines all regulations on invoices and documents into a single legal framework, making the legal system clearer and more consistent. Instead of referencing multiple documents (like Decree 51 for paper invoices and Decree 119 for e-invoices), businesses now only need to rely on Decree 123 for all invoice-related matters. Its expanded scope includes various types of electronic documents (tax receipts, fees, charges) that were not addressed in Decree 119. This reflects a broader digital transformation in tax administration—not just for enterprise invoices but also for public sector documents.

- Additional Invoice Types and Entities: Decree 123 introduces two new types of e-invoices (for the sale of public assets and national reserve goods) to manage special state transactions. The decree also extends the obligation to use e-invoices to tax/fee collection bodies (e.g., treasury offices, public service agencies) and invoice service providers (who are now subject to stricter regulation). This expansion ensures comprehensive coverage of all actors involved in invoicing, eliminating legal loopholes.

- Reasonable Deadline Extension: A practical benefit of Decree 123 was the extension of the mandatory e-invoice deadline to July 1, 2022 (instead of November 1, 2020, under Decree 119). This gave businesses and tax authorities an additional 20 months to prepare infrastructure and training. In practice, by mid-2022, business readiness was much higher than in late 2020, reducing pressure on both taxpayers and tax officers.

- Transparent and Streamlined Electronic Processes: Decree 123 (with accompanying guidance) sets up a fully digital process for tax ID registration, e-invoice management, and code issuance. Invoice data is updated in real time to the General Department of Taxation, allowing for close monitoring and rapid fraud detection. The decree also clearly defines prohibited behaviors and illegal invoice use through seven specific violations—providing a solid legal basis for enforcement. Notably, it introduces the concept of delegated e-invoice issuance (Article 17), giving businesses flexibility—something not covered in Decree 119.

- Convenience and Cost Savings: E-invoices under Decree 123 offer numerous benefits: businesses save on printing and storage; old invoices are easily retrieved; customers receive invoices instantly via email or online portals. Tax authorities also save on management costs (no more printing/distributing invoices or manually entering data). Overall, Decree 123 promotes a more transparent, fair business environment, as all transactions must be declared—limiting revenue concealment. This brings macro-level benefits to the economy.

Remaining Challenges:

- Nationwide Implementation Difficulties: Despite a complete legal foundation, nationwide implementation within a short time faced obstacles. For example, limited IT infrastructure in some small businesses or remote areas, and unstable internet connections, could hinder e-invoice issuance. Tax offices also had to upgrade systems to handle billions of invoices annually without technical failures. During the early rollout (late 2021 to mid-2022), some businesses reported slow portal connections at peak hours or confusion in transitioning (e.g., canceling leftover paper invoices, incorrect registration). While these issues are gradually resolved, they represent unavoidable transition costs.

- Compliance Costs for Some Groups: For small household businesses, even with support, e-invoicing requires changes in business habits, access to digital devices, and basic tech skills. Some may find e-invoicing more complex than handwritten paper invoices, especially those unfamiliar with digital tools. Additionally, businesses seeking to integrate e-invoices with their internal accounting or ERP systems may incur costs for software upgrades or external services—creating short-term financial burdens.

- Legal and Awareness Issues: Some real-world situations are not yet fully addressed in the decree, such as how to handle erroneous e-invoices (replacement, adjustment, cancellation of invoices with tax codes). Tax officials and businesses must update their knowledge of new regulations (Decree 123 and Circular 78/2021), which differ significantly from previous rules, requiring time to fully grasp. Some small businesses initially resist change and need further encouragement and communication on the long-term benefits.

Conclusion

Through the comparison of Decree 123/2020/NĐ-CP with Decrees 51/2010 and 119/2018, we can see a comprehensive picture of the invoice management transition in Vietnam. The shift from traditional paper invoices to modern e-invoices is an inevitable process, aligning with technological trends and the economy’s transparency demands. Each decree played a key role in its era: Decree 51 laid the groundwork for autonomy, Decree 119 drove digital transformation, and Decree 123 completed the legal framework to realize that goal.

For the business community and the public, this transformation offers long-term benefits: faster processes, lower costs, and a more transparent, equitable business environment. Of course, there are short-term challenges to overcome—like technology investment, learning new systems, and adapting to digital workflows. However, with strong government commitment and business cooperation, these issues are gradually being addressed.

Decree 123/2020/NĐ-CP can be considered the final step in this transition, establishing a smart, efficient invoice management system. From July 1, 2022, Vietnam officially entered the era of comprehensive e-invoicing—a crucial foundation for modern tax administration, reducing revenue losses, and contributing to building an e-government and a digital economy.