Menu

Issued in the context of Vietnam’s rapid technological advancement and digital transformation, the decree replaces a series of earlier legal provisions, harmonizing the system and promoting efficiency in both business operations and tax administration.

This decree was designed not only to standardize invoicing practices but also to facilitate Vietnam’s transition to a digital economy. With the increasing integration of digital technologies in economic activities, Decree 123/2020/NĐ-CP aims to create a unified legal environment that supports the effective application of electronic invoices (e-invoices) and other digital tax documentation.

The Vietnamese government, through this decree, seeks to accelerate the adoption of e-invoices across businesses of all sizes, particularly among small and medium-sized enterprises (SMEs), by mandating a nationwide shift from paper-based to electronic invoicing. This not only reduces paperwork but also enhances tax compliance and transparency.

Objectives and Legal Significance

The overarching goal of Decree 123 is to simplify the invoicing process, reduce administrative burden, and strengthen the transparency and accuracy of financial transactions. It serves as a pivotal legal foundation that consolidates and replaces outdated regulations, ensuring consistency with the requirements of the digital economy.

Before the decree’s enforcement, the government and tax authorities had encouraged organizations with sufficient technological capacity to voluntarily adopt e-invoicing solutions in accordance with the decree’s guidelines. The official implementation deadline for mandatory nationwide e-invoice adoption was set for July 1, 2022, giving businesses ample time to transition.

Scope of Application

Decree 123/2020/NĐ-CP has a wide scope of application, covering virtually all entities engaged in economic, commercial, and administrative activities involving goods, services, and taxation. The primary subjects include businesses and individuals involved in the sale of goods or the provision of services; branches of foreign companies, cooperatives, and public service units with commercial operations; and organizations not classified as enterprises but still engaging in business activities.

In addition to sellers, the decree also applies to buyers of goods and services, tax, fee, and charge collection agencies, taxpayers and tax withholding agents, organizations responsible for invoice or document printing or providing invoicing software or services, as well as tax authorities at all administrative levels and customs agencies. Compared to previous regulations, such as Decree 119/2018/NĐ-CP, Decree 123 significantly expands the list of applicable entities, aiming to make electronic invoicing a standardized practice across Vietnam’s economy.

Compared to previous regulations, such as Decree 119/2018/NĐ-CP, Decree 123 significantly expands the list of applicable entities, aiming to make electronic invoicing a standardized practice across Vietnam’s economy.

Regulatory Coverage and Provisions

The decree governs the management and use of invoices in commercial transactions and also addresses the use of documents for tax, fee, and charge procedures. It introduces clear rules on prohibited behaviors in invoice and document management and outlines the timing and content requirements for invoice issuance in various business scenarios.

Among its most notable provisions is the detailed guidance on e-invoices generated from Point of Sale (POS) systems or cash registers. These types of invoices are critical for retail and service sectors, where real-time transaction processing is essential.

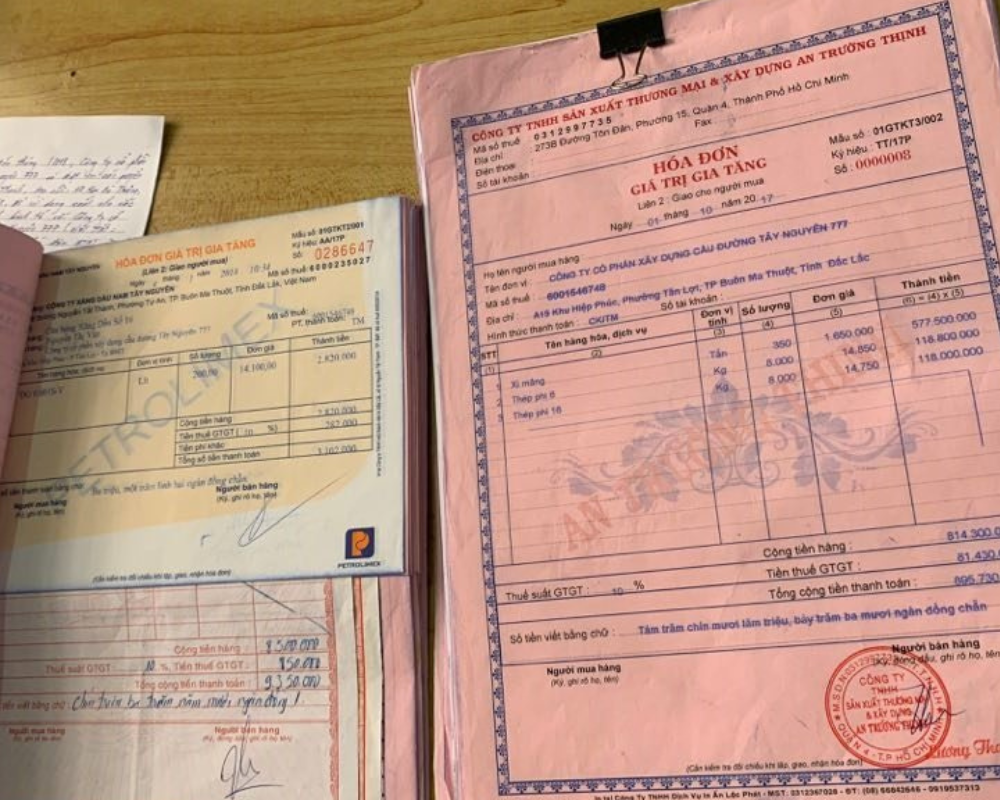

The decree also provides transitional guidelines for the continued use of tax authority-printed paper invoices until June 30, 2022, after which all entities are required to adopt e-invoicing.

Key Differences from Previous Decrees

Decree 123 introduces substantial changes and improvements compared to Decree 119/2018/NĐ-CP. Key differences include:

Expanded Applicability: In addition to traditional sellers and buyers, the new decree includes tax collection units, printing providers, and software vendors.

New Invoice Types: Adds e-invoices for public asset sales and national reserve transactions.

Clearer Prohibitions: Provides more explicit definitions of forbidden practices, including those applicable to tax officials.

Specific Timing: Offers detailed guidance on when invoices must be issued for various service delivery and goods transfer models.

POS Invoice Regulations: Introduces new rules for e-invoices generated from connected cash registers, a feature not present in earlier regulations.

Revised Deadline: Extends the mandatory implementation of e-invoices to July 1, 2022, from the previous deadline of November 1, 2020.

POS-Generated E-Invoices: A Key Innovation

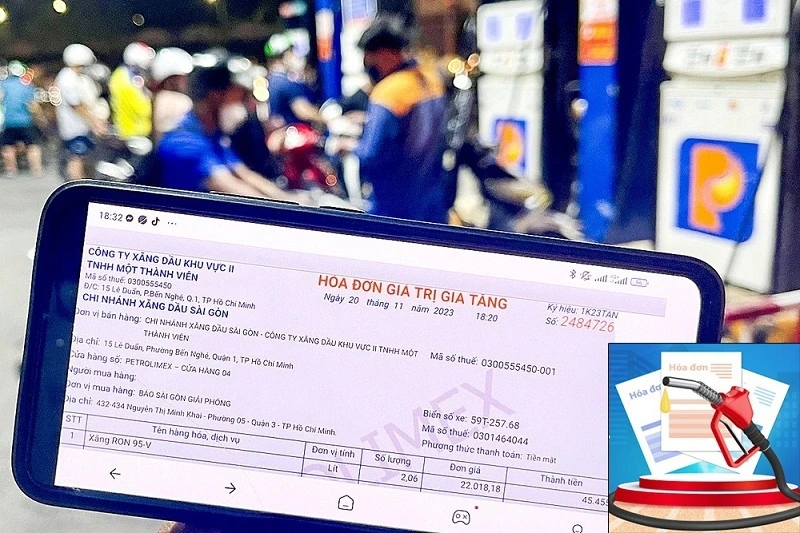

One of the most groundbreaking elements of Decree 123 is its formal recognition of electronic invoices generated directly from cash registers or point-of-sale (POS) systems. These invoices are intended to streamline retail transactions by enabling fast, transparent processing while eliminating the need for traditional paper receipts. As specified in the decree, each invoice must contain essential information such as the seller’s name, address, tax identification number, detailed transaction data (including items sold, quantities, unit prices, and total payment), the time of issuance, and a code issued by the tax authority.

Notably, a digital signature is not required for invoices generated through POS systems. However, sellers are obligated to register their use of such invoices and transmit the data to the tax authority’s portal on the same day the transaction occurs. Additionally, each POS system must be directly linked to the General Department of Taxation to enable real-time data transmission. This innovation not only facilitates 24/7 invoicing but also improves traceability and allows for seamless end-of-day corrections without the need for specialized hardware.

Timing of Invoice Issuance

The decree provides clear guidance on when invoices must be issued across different business scenarios, aiming to reduce ambiguity and promote consistency. For goods sales, invoices must be issued at the point when ownership or usage rights are transferred. In the case of service provision, invoices are required upon completion of the service or when payment is received, excluding deposit transactions.

For transactions involving multiple deliveries or staged project implementation, invoices must be issued at each stage or upon each delivery. In the case of recurring services—such as utilities or logistics—invoice issuance is based on data reconciliation, but must occur no later than the 7th day of the following month. For point-of-sale (POS) transactions, invoices must be generated at the exact time of the sale or service. These detailed provisions ensure uniform invoicing practices across various industries and business models.

Prohibited Practices

Decree 123 outlines several prohibited acts related to invoicing and document management. For tax officiDecree 123 outlines a range of prohibited acts concerning invoicing and document management, applying to both tax officials and taxpayers. For tax officials, the decree explicitly forbids actions such as soliciting bribes, colluding in the illegal use of invoices, and deliberately causing delays in administrative processes.

Businesses and individuals are also subject to strict prohibitions, including the use or distribution of unauthorized invoices, obstructing tax officers in the performance of their duties, forging invoices or tampering with invoice data, failing to transmit electronic invoice data to tax authorities as required, and illegally accessing invoice information systems. These regulations are designed to promote transparency, ensure accountability, and uphold fairness within the tax administration system.

Benefits for Businesses and Tax Authorities

The implementation of Decree 123 brings significant advantages for businesses. It streamlines invoicing workflows by reducing reliance on physical paperwork, which in turn lowers printing and storage costs. Electronic invoicing also enhances transparency in financial reporting, facilitates faster transaction processing, and supports real-time reconciliation with easier error correction—particularly for invoices generated through POS systems. These benefits contribute to more efficient business operations and improved accuracy in financial management.

For tax authorities, Decree 123 simplifies tax filing and compliance processes while providing enhanced visibility into business activities. The use of electronic invoices improves transparency, reduces the risk of tax evasion, and enables real-time monitoring through data captured from POS systems. Additionally, the centralized collection of tax data supports more effective analysis and the development of informed tax policies, contributing to a more robust and accountable tax administration system.

Conclusion

Decree 123/2020/NĐ-CP marks a transformative milestone in Vietnam’s journey toward digital governance and financial transparency. By mandating electronic invoicing, particularly through POS systems, the decree paves the way for more efficient, accurate, and transparent tax and business practices.

Although the transition may initially pose challenges—such as technology investment and staff training—the long-term benefits far outweigh the costs. With proper guidance from tax authorities and support from technology providers, businesses will be better positioned to thrive in a competitive, digitally connected economy.

As Decree 123 continues to be implemented and refined, it will play a central role in fostering a more professional, transparent, and globally integrated business environment in Vietnam.