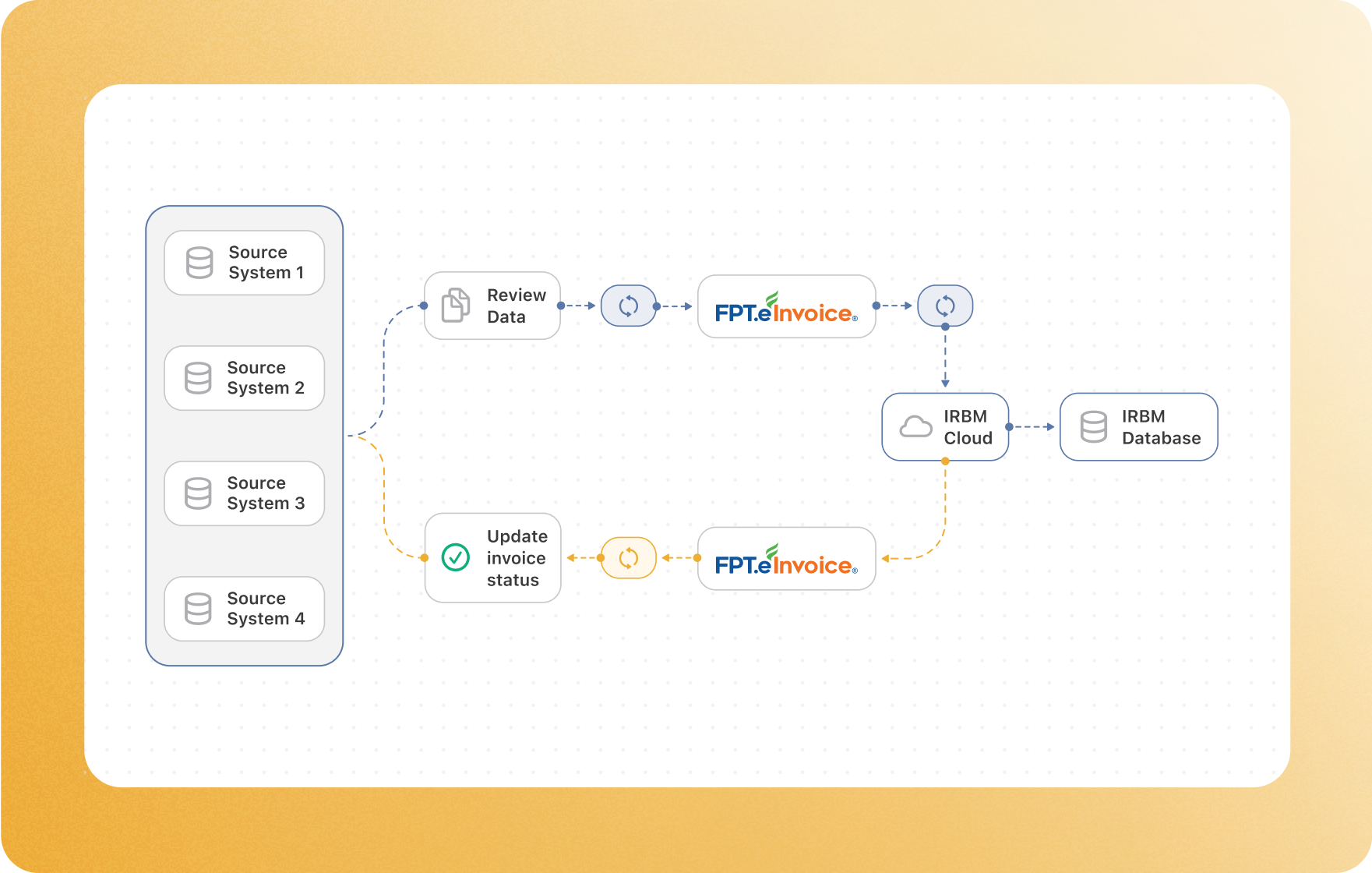

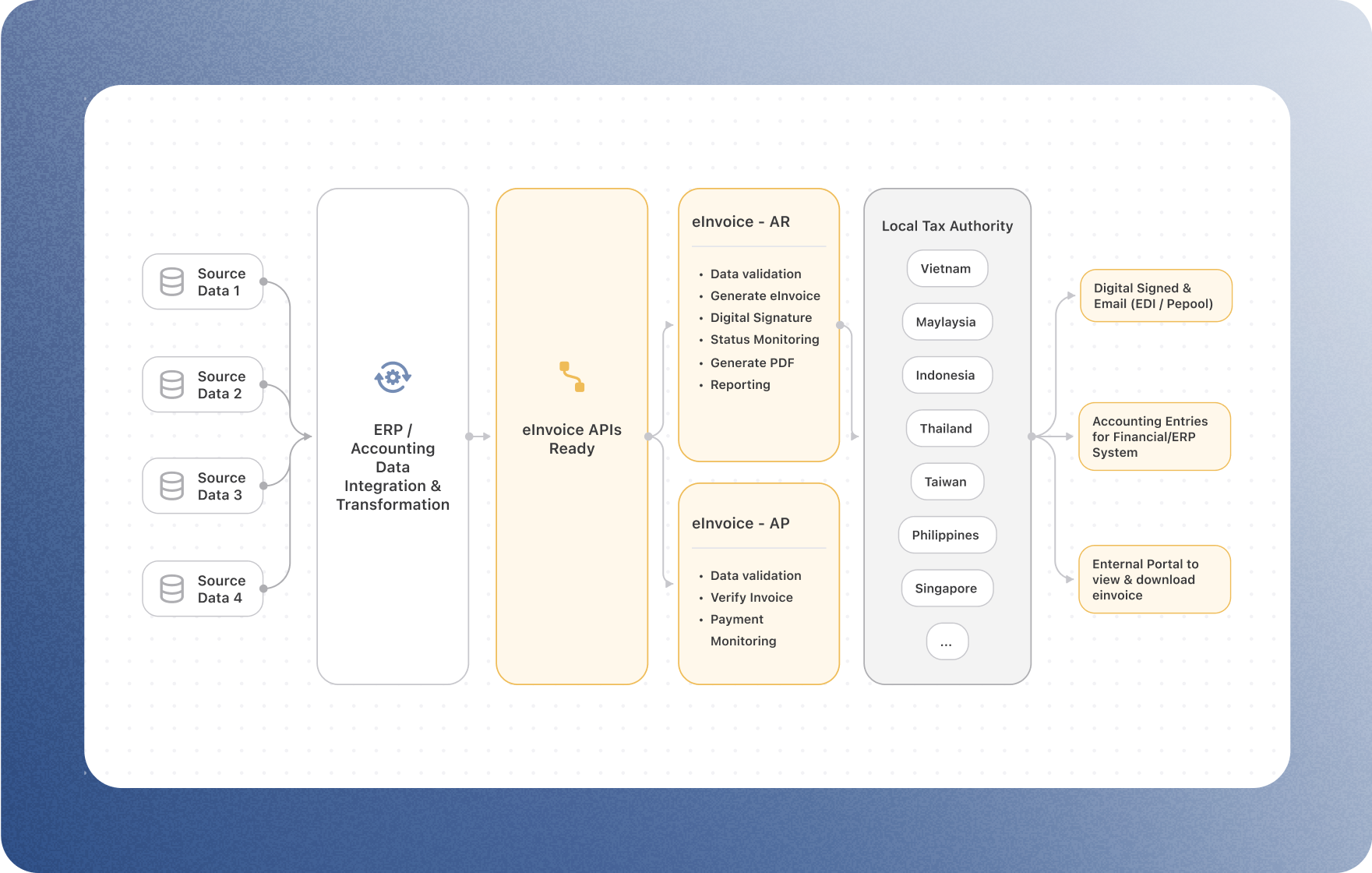

Accommodate various scenarios for both outbound and inbound invoices.

Collate the mandatory data fields from multiple data sources.

Simplify compliance with end-to-end process integration and capability to extend to e-reporting.

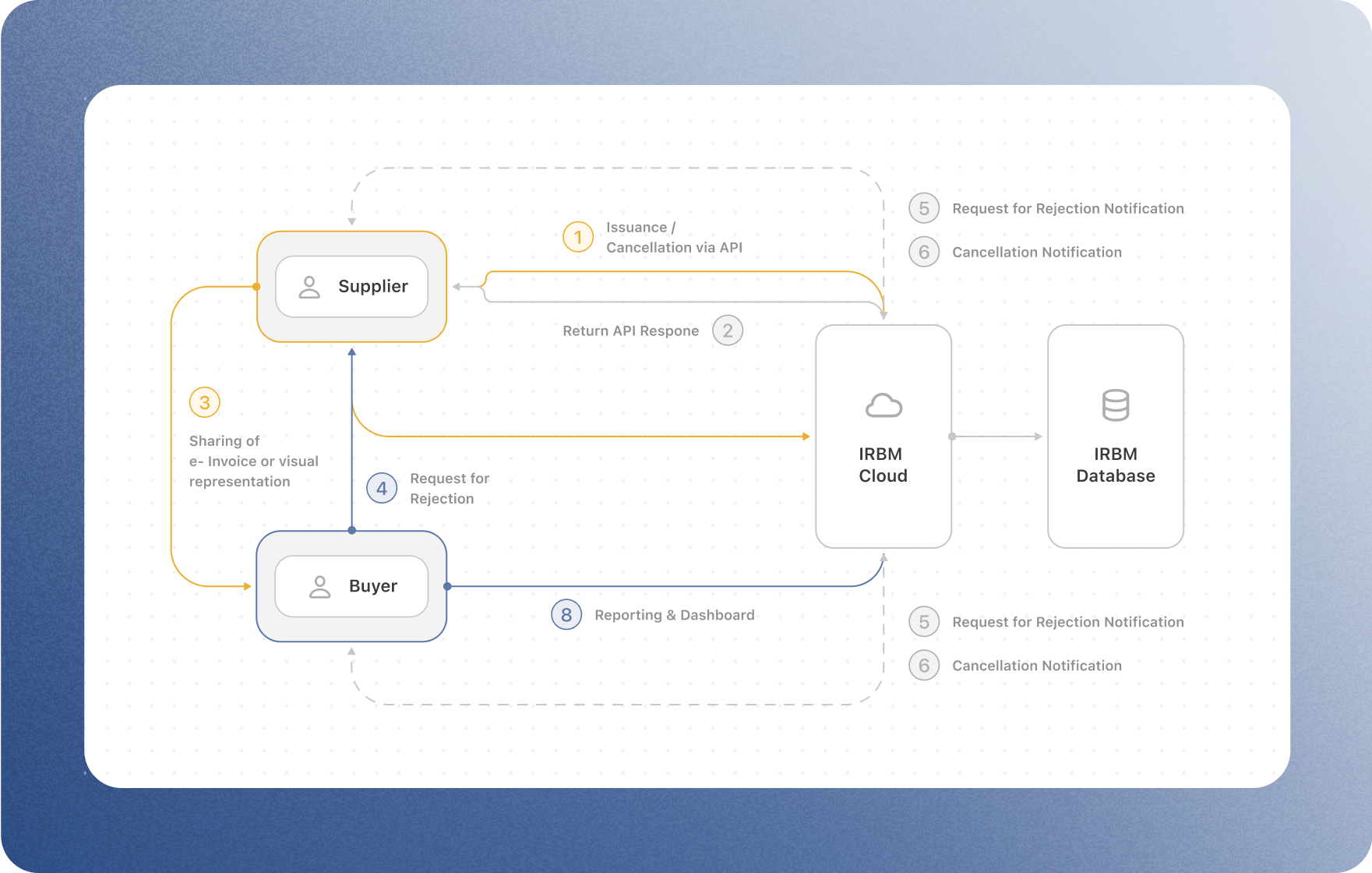

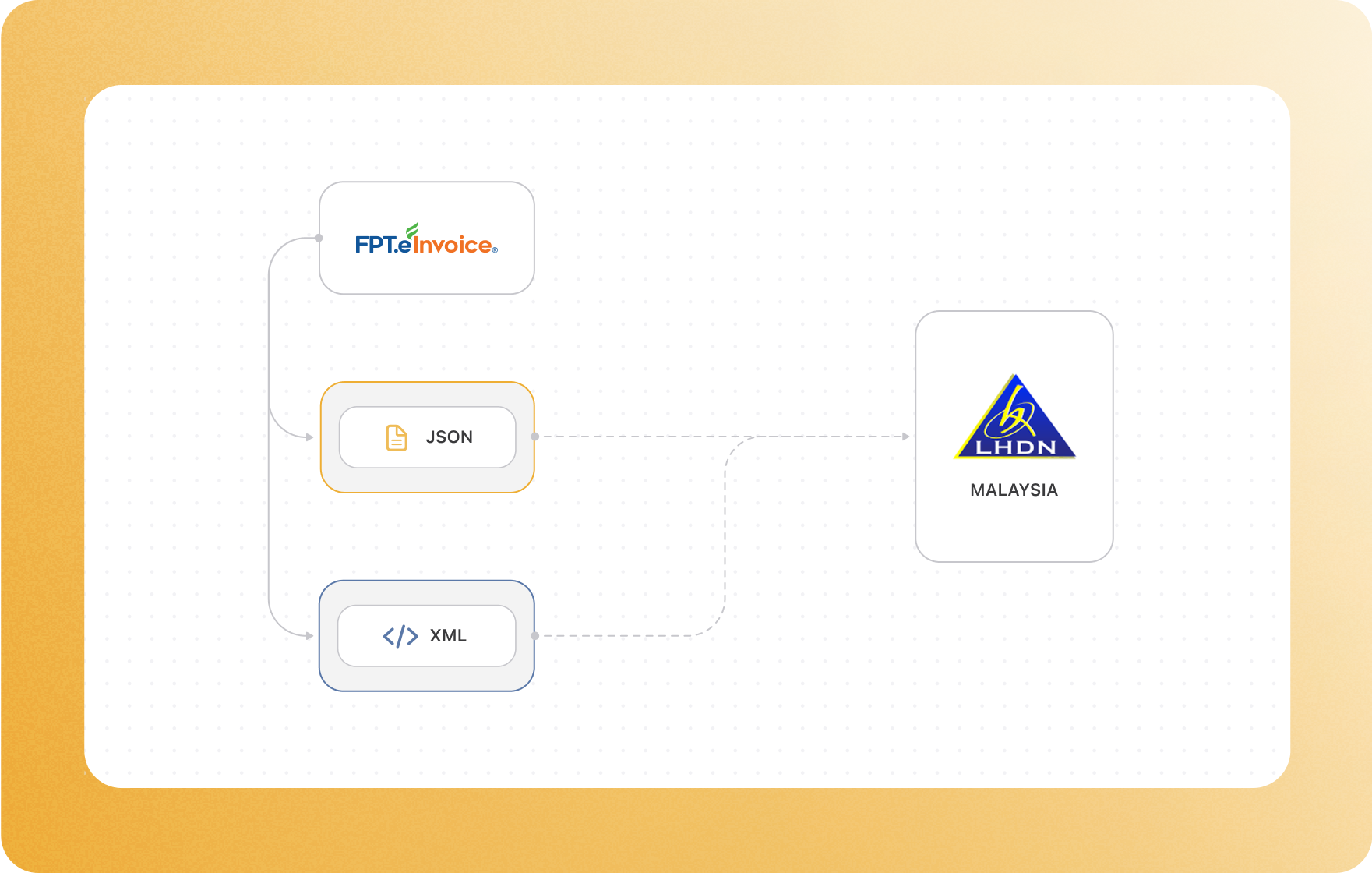

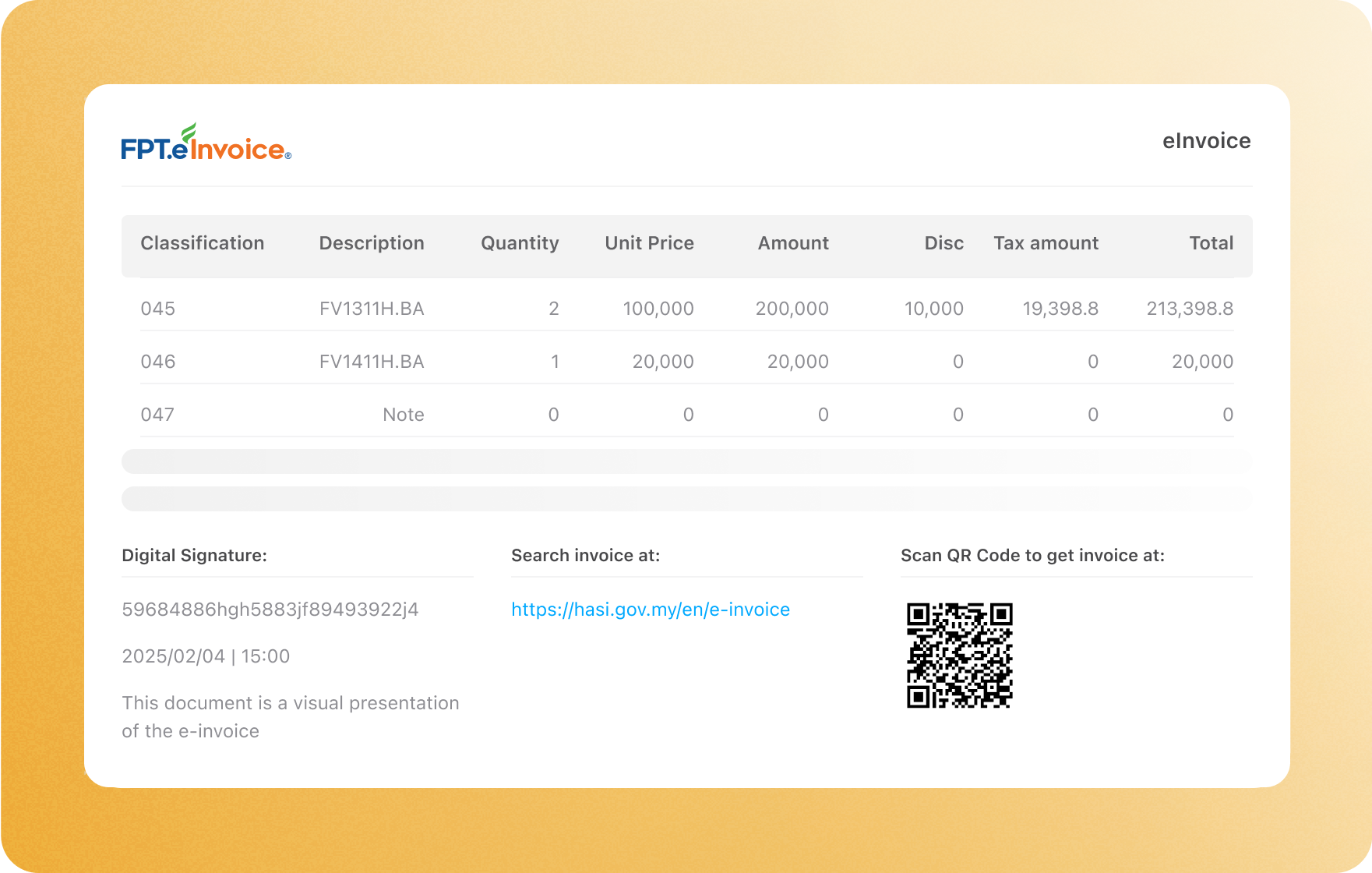

Generate and issue e-Invoices via API in XML/JSON format.

Manage AR invoices, including creation, debit, credit, refund notes, and consolidating invoices.

Retrieve AP invoices from Peppol and IRBM portals, and manage their validity and payment status.

Reject invoice.

Adheres to global climate reporting standards with assurance-grade GHG data.

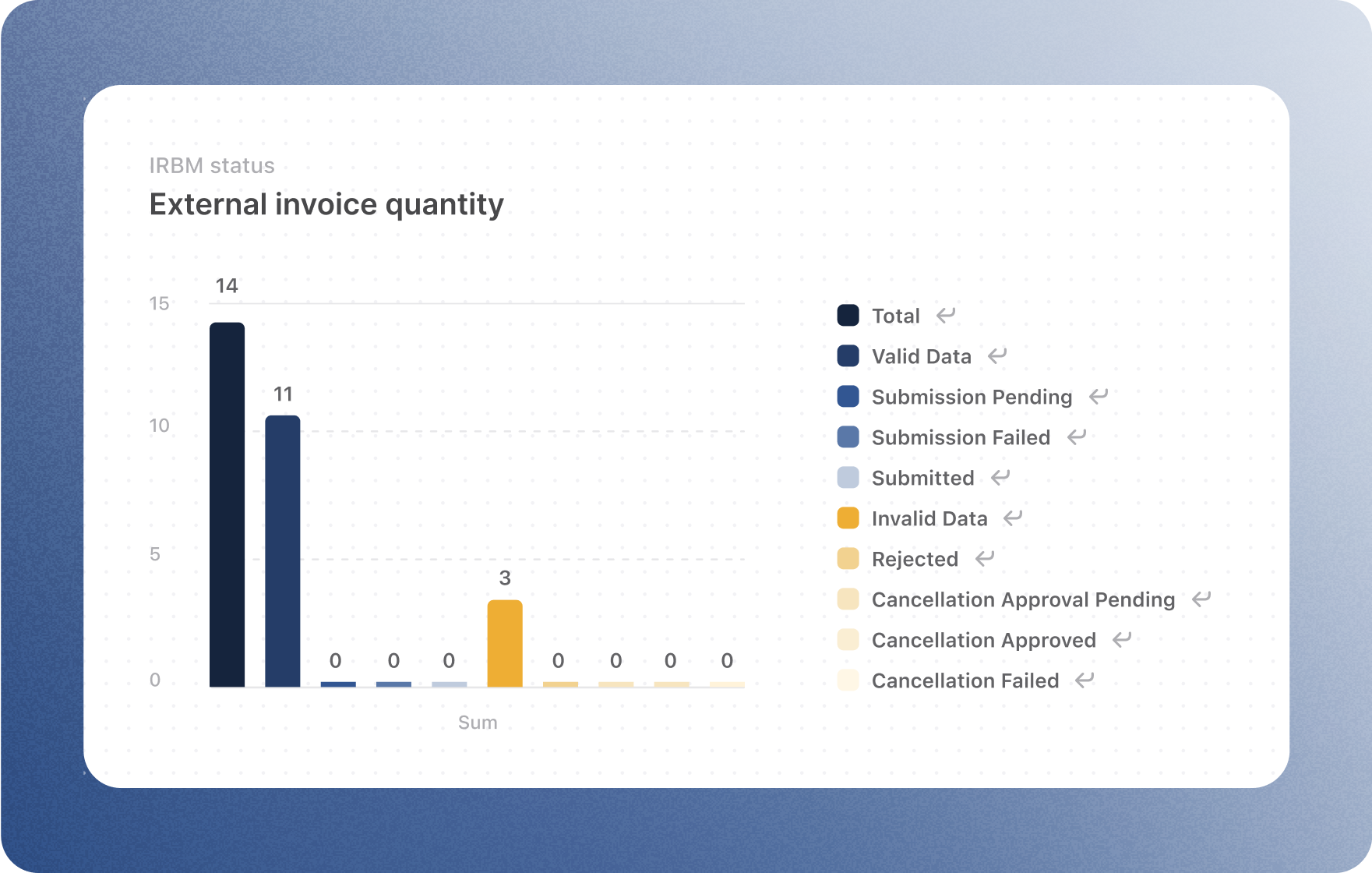

Provide dashboard for a summary of transactions and reconciliations.